Spirit Airlines 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

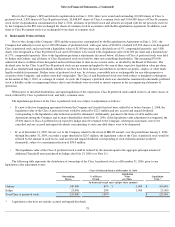

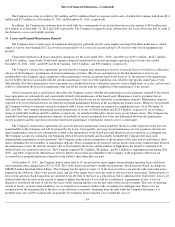

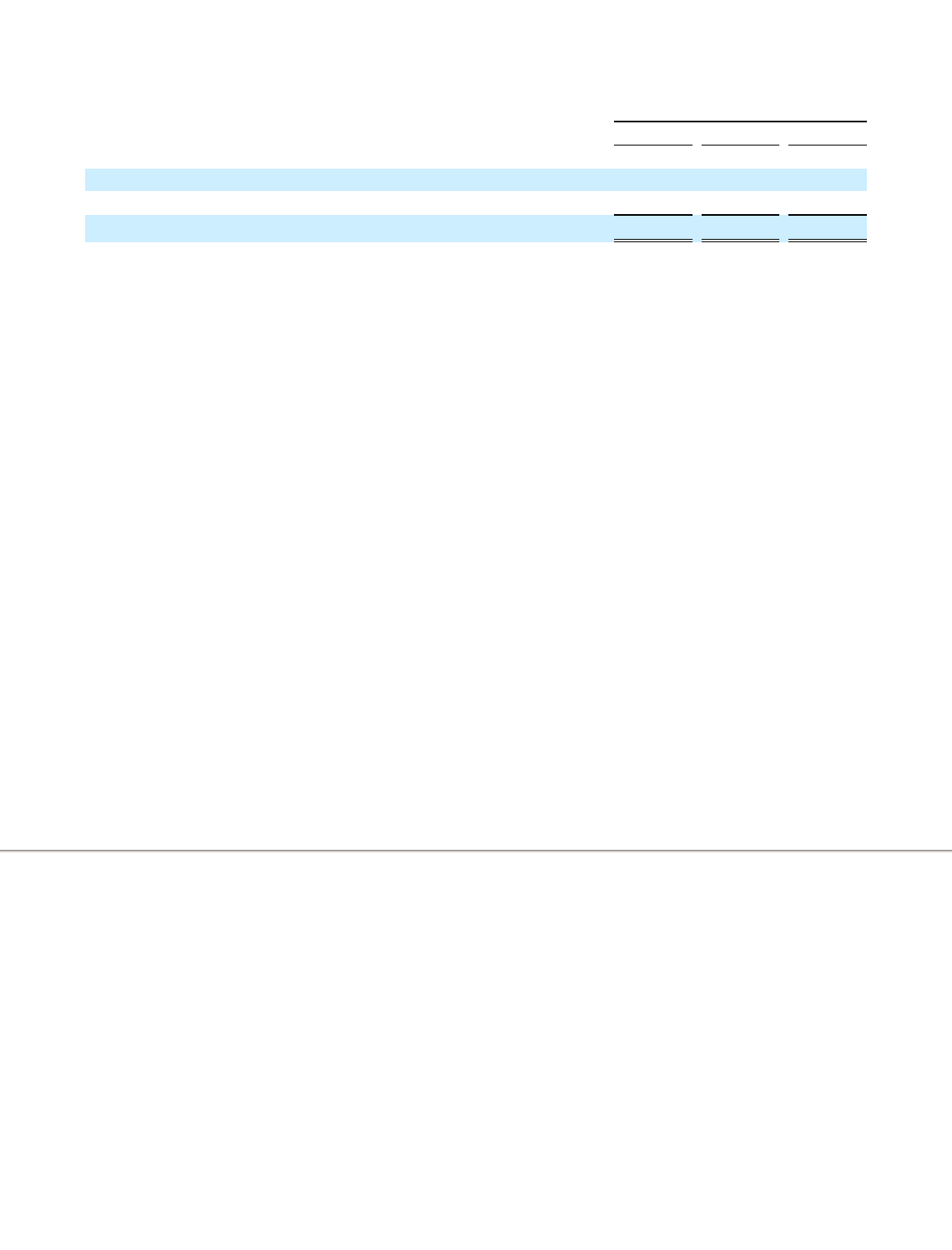

The following table summarizes the components of aircraft fuel expense for the years ended December 31, 2011 , 2010 and 2009 :

During the year ended 2011 , $4.2 million of net fuel derivative gains were recognized consisting of realized gains of $7.4 million

offset by

unrealized mark-to-market losses of $3.2 million . During the year ended 2010 , $3.5 million of net fuel derivative gains were recognized

consisting of settlement gains of $1.4 million and unrealized mark-to-market gains of $2.1 million . During the year ended 2009 , $0.7 million of

net fuel derivative gains were recognized consisting of realized losses of $0.7 million and unrealized mark-to-market gains of $1.4 million . All

realized gains and losses are reflected in the statements of cash flows in cash flow from operating activities.

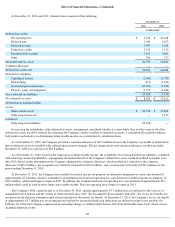

As of December 31, 2011 and 2010, the Company had fuel hedges using US Gulf Coast jet fuel as the underlying commodity. As of

December 31, 2011 , the Company had agreements in place to protect 13,450,000 gallons or approximately 9% of its 2012 anticipated fuel

consumption at a weighted-average ceiling and floor price of $2.99 and $2.81 per gallon, respectively. As of December 31, 2010 , the Company

had agreements in place to protect 11,800,000 gallons or approximately 10% of its 2011 anticipated fuel consumption at a weighted-average

ceiling and floor price of $2.30 and $2.13 per gallon, respectively.

The Company sponsors two defined contribution 401(k) plans, Spirit Airlines, Inc. Employee Retirement Savings Plan (first plan) and

Spirit Airlines, Inc. Pilots’ Retirement Savings Plan (second plan). The first plan was adopted on February 1, 1994. Essentially, all employees

that are not covered by the pilots’ collective bargaining agreement, who have at least one year of service, have worked at least 1,000 hours

during the year, and have attained the age of 21 may participate in this plan. The Company may make a Qualified Discretionary Contribution, as

defined in the plan, or provide matching contributions to this plan. Effective July 1, 2007, the Company amended this plan to change the service

requirement to 60 days and provided for matching contribution to the plan at 50% of the employee’s contribution, up to 6% of the employee’s

annual compensation.

The second plan is for the Company’s pilots, and contained the same service requirements as the first plan and was amended effective

July 1, 2007, to change the service requirements to 60 days and having attained the age of 21. The Company matches 100% of the pilot’s

contribution, up to 8% of the individual pilot’s annual compensation.

Matching contributions made to both plans were $4.9 million , $4.8 million and $3.9 million in 2011 , 2010 and 2009 , respectively, and

were included within salaries, wages and benefits in the accompanying statements of operations.

86

Year Ended December 31,

2011

2010

2009

Into-plane fuel cost

$

392.3

$

251.7

$

181.8

Changes in value and settlements of fuel hedge contracts

(4.2

)

(3.5

)

(0.7

)

Aircraft fuel expense

$

388.1

$

248.2

$

181.1

15.

Defined Contribution 401(k) Plan