Pottery Barn 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

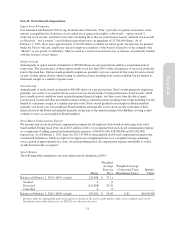

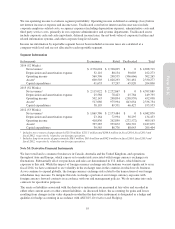

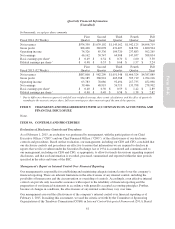

Quarterly Financial Information

(Unaudited)

In thousands, except per share amounts

Fiscal 2014 (52 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $974,330 $1,039,102 $1,143,162 $1,542,125 $4,698,719

Gross profit 368,408 382,098 431,407 618,591 1,800,504

Operating income 74,326 85,336 104,720 237,883 502,265

Net earnings 46,162 50,747 64,908 147,037 308,854

Basic earnings per share1$ 0.49 $ 0.54 $ 0.70 $ 1.60 $ 3.30

Diluted earnings per share1$ 0.48 $ 0.53 $ 0.68 $ 1.57 $ 3.24

Fiscal 2013 (52 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $887,808 $ 982,209 $1,051,548 $1,466,324 $4,387,889

Gross profit 334,185 368,924 405,388 595,719 1,704,216

Operating income 63,783 78,086 92,494 217,735 452,098

Net earnings 39,466 48,919 56,719 133,798 278,902

Basic earnings per share1$ 0.40 $ 0.50 $ 0.59 $ 1.42 $ 2.89

Diluted earnings per share1$ 0.40 $ 0.49 $ 0.58 $ 1.38 $ 2.82

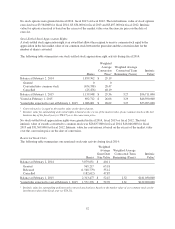

1Due to differences between quarterly and full year weighted average share count calculations, and the effect of quarterly

rounding to the nearest cent per share, full year earnings per share may not equal the sum of the quarters.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As of February 1, 2015, an evaluation was performed by management, with the participation of our Chief

Executive Officer (“CEO”) and our Chief Financial Officer (“CFO”), of the effectiveness of our disclosure

controls and procedures. Based on that evaluation, our management, including our CEO and CFO, concluded that

our disclosure controls and procedures are effective to ensure that information we are required to disclose in

reports that we file or submit under the Securities Exchange Act of 1934 is accumulated and communicated to

our management, including our CEO and CFO, as appropriate, to allow for timely discussions regarding required

disclosures, and that such information is recorded, processed, summarized and reported within the time periods

specified in the rules and forms of the SEC.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over the company’s

financial reporting. There are inherent limitations in the effectiveness of any internal control, including the

possibility of human error and the circumvention or overriding of controls. Accordingly, even effective internal

control can provide only reasonable assurance with respect to the reliability of financial reporting and the

preparation of our financial statements in accordance with generally accepted accounting principles. Further,

because of changes in conditions, the effectiveness of any internal control may vary over time.

Our management assessed the effectiveness of the company’s internal control over financial reporting as of

February 1, 2015. In making this assessment, we used the criteria set forth by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013). Based

61

Form 10-K