Pottery Barn 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Investing in our supply chain – We completed the insourcing of our foreign buying offices, which will

not only reduce cost but improve quality and strengthen our supplier relationships. In addition, we

continue to refine our domestic supply chain by insourcing more of our furniture delivery operations. We

also made significant progress in automating aspects of our personalization capability.

•Investing in e-commerce, as well as technology and infrastructure – We implemented technology

enhancements to improve customer service and advance the flexibility and capacity of our e-commerce

platform. In fiscal 2014, e-commerce represented over 50% of our net revenues.

We have driven consistent profitable growth through innovation, operational excellence and our customer-

centered approach, along with exceptional financial discipline. We believe that our long-term outlook is strong

and that there is a significant opportunity to expand our reach domestically and globally.

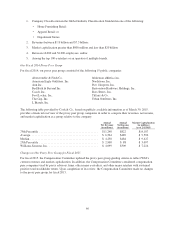

Our Compensation Program Aligns and Advances Executive and Stockholder Interests

Our compensation program is constructed to attract, motivate and retain exceptional executives in support of our

primary objective to create long-term value for stockholders. Fundamentally, we believe that earnings per share,

or EPS, is the measure most closely aligned with long-term stockholder value and, as such, each executive’s

bonus payout is dependent on the company’s achievement of an annual EPS goal.

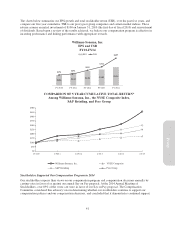

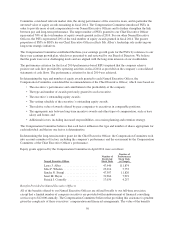

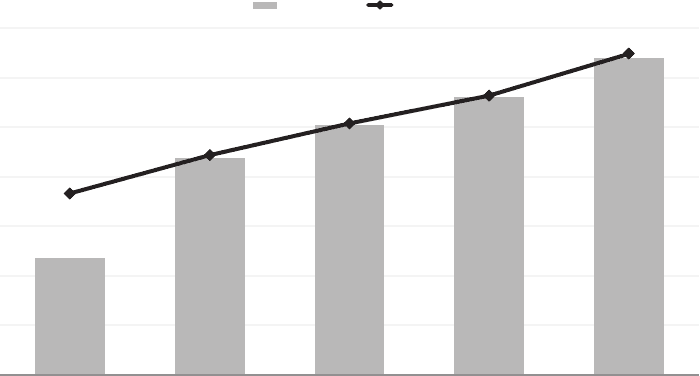

The chart below illustrates the year over year increases of our target performance goals under our 2001 Incentive

Bonus Plan, as well as our EPS. Our performance goals are consistently set higher than the previous year’s EPS.

$1.83

$2.22

$2.54

$2.82

$3.24

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$3.50

$3.00

FY 2010 FY 2011 FY 2012 FY 2013 FY 2014

Annual Bonus - EPS Performance Goals

FY10-FY14

Target EPS

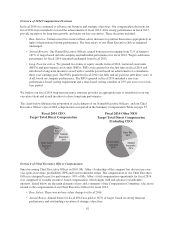

Similarly, our equity compensation and stock ownership guidelines are structured to encourage our executives to

deliver long-term sustained growth in our stock price. We believe this dual approach aligns executive and

stockholder interests. When we exceed targeted performance levels and/or our stock price appreciates, our

executives’ compensation opportunity is substantially increased. When we do not achieve targeted performance

levels and/or our stock price does not appreciate, our executives’ compensation opportunity is substantially

reduced.

40