Pottery Barn 2014 Annual Report Download - page 122

Download and view the complete annual report

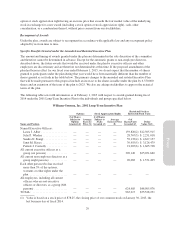

Please find page 122 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Includes (i) restricted stock unit award of 47,946 shares of common stock made on April 22, 2014 and

(ii) performance stock unit award of 111,874 shares of common stock at target payout made on April 22,

2014.

(3) Includes (i) restricted stock unit award of 23,014 shares of common stock at target payout made on April 22,

2014 and (ii) performance stock unit award of 5,753 shares of common stock at target payout made on

April 22, 2014.

(4) Includes (i) restricted stock unit award of 47,307 shares of common stock made on April 22, 2014 and

(ii) performance stock unit award of 11,826 shares of common stock at target payout made on April 22,

2014.

(5) Includes (i) restricted stock unit award of 31,964 shares of common stock made on April 22, 2014 and

(ii) performance stock unit award of 7,991 shares of common stock at target payout made on April 22, 2014.

(6) Includes (i) restricted stock unit award of 17,030 shares of common stock made on April 22, 2014 and

(ii) performance stock unit award of 4,257 shares of common stock at target payout made on April 22, 2014.

Recommendation that the 2001 Long-Term Incentive Plan be Amended and Restated and its Material

Terms Approved

We believe that the amended and restated Incentive Plan and the approval of its material terms are essential to

our continued success. Our employees are our most valuable asset. Equity awards such as those provided under

the plan will substantially assist us in continuing to attract and retain employees and non-employee directors in

the extremely competitive labor markets in which we compete. Such awards also are crucial to our ability to

motivate employees to achieve our goals. We will benefit from increased stock ownership by selected executives,

other employees and non-employee directors. The increase in the reserve of common stock available under the

plan will enable us to continue to grant such awards to executives, other eligible employees and our non-

employee directors.

Required Vote for this Proposal

To approve this proposal, a majority of voting power entitled to vote thereon, present in person or represented by

proxy, at the Annual Meeting must vote “FOR” this proposal.

If approved, when would the amended and restated plan become effective?

The amended and restated Incentive Plan would become effective upon stockholder approval at the Annual

Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE 2001 LONG-TERM INCENTIVE

PLAN.

30