Pottery Barn 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition, results of operations, and liquidity and capital

resources for the 52 weeks ended February 1, 2015 (“fiscal 2014”), the 52 weeks ended February 2, 2014 (“fiscal

2013”), and the 53 weeks ended February 3, 2013 (“fiscal 2012”) should be read in conjunction with our

Consolidated Financial Statements and notes thereto. All explanations of changes in operational results are

discussed in order of magnitude.

OVERVIEW

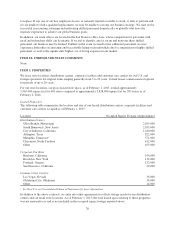

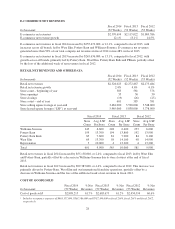

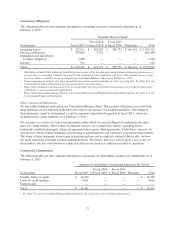

In fiscal 2014, our net revenues increased 7.1% to $4,698,719,000, compared to $4,387,889,000 in fiscal 2013,

with comparable brand revenue growth of 7.1%. Diluted earnings per share increased to $3.24 in fiscal 2014

(including a $0.04 benefit from our share of the VISA/MasterCard antitrust litigation settlement), versus $2.82 in

fiscal 2013 (including a $0.02 charge related to the retirement of one of our former brand presidents), and we

returned $350,135,000 to our stockholders through stock repurchases and dividends.

E-commerce net revenues in fiscal 2014 increased by $255,672,000, or 12.1%, compared to fiscal 2013, with

increases across all brands, led by West Elm, Pottery Barn and Williams-Sonoma. E-commerce net revenues

generated more than 50% of our total company net revenues in fiscal 2014 versus 48% in fiscal 2013.

Retail net revenues in fiscal 2014 increased by $55,158,000, or 2.4%, compared to fiscal 2013, led by West Elm

and Pottery Barn, partially offset by a decrease in Williams-Sonoma due to store closures at the end of fiscal

2013.

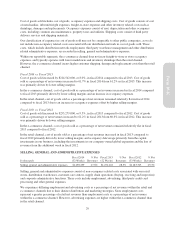

During fiscal 2014, we had net revenue growth in all of our brands and across channels. In Pottery Barn, our

largest brand, comparable brand revenues increased 5.8% in fiscal 2014, on top of an increase of 10.4% in fiscal

2013. This growth was primarily driven by our upholstery and leather furniture collections. In the Williams-

Sonoma brand, comparable brand revenues increased 3.8% in fiscal 2014 compared to fiscal 2013, with solid

performance across our cookware, food, entertaining and tabletop product categories. In West Elm, comparable

brand revenues grew 18.2% in fiscal 2014, on top of an increase of 17.4% in fiscal 2013. Growth in the brand

was broad-based across all categories. In Pottery Barn Kids, comparable brand revenues increased 5.9% in fiscal

2014 compared to fiscal 2013, led by our nursery, furniture, seasonal and school gear collections. In PBteen,

comparable brand revenues increased 5.7% in fiscal 2014, on top of an increase of 14.1% in fiscal 2013, driven

by our textiles and furniture collections.

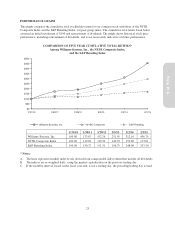

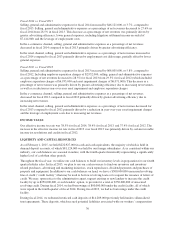

In fiscal 2014, we made progress against our long-term strategic growth initiatives, including strengthening our

brands; laying the foundation for global expansion and new business development; investing in our supply chain

to reduce cost and improve service; and investing in e-commerce, as well as the technologies and infrastructure

underlying all of our initiatives.

As we look to fiscal 2015, we plan to invest in those areas where we see sustainable, long-term returns for our

stockholders by making investments in: our e-commerce platform; our supply chain initiatives; new stores,

particularly in the West Elm brand; and our longer-term growth initiatives, including our newer businesses and

global expansion. Looking ahead, we see opportunities for continued growth and believe we are well positioned

to deliver on all of our long-term strategic growth initiatives.

26