Pottery Barn 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

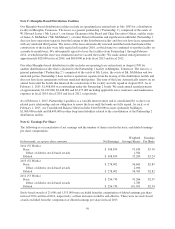

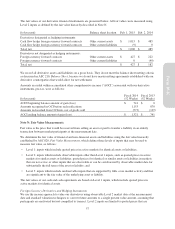

Note H: Stock-Based Compensation

Equity Award Programs

Our Amended and Restated 2001 Long-Term Incentive Plan (the “Plan”) provides for grants of incentive stock

options, nonqualified stock options, stock-settled stock appreciation rights (collectively, “option awards”),

restricted stock awards, restricted stock units (including those that are performance-based), deferred stock awards

(collectively, “stock awards”) and dividend equivalents up to an aggregate of 25,760,000 shares. As of

February 1, 2015, there were approximately 4,354,000 shares available for future grant. Awards may be granted

under the Plan to officers, employees and non-employee members of the board of directors of the company (the

“Board”) or any parent or subsidiary. Shares issued as a result of award exercises or releases are primarily funded

with the issuance of new shares.

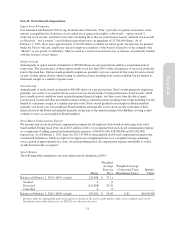

Option Awards

Annual grants of option awards are limited to 1,000,000 shares on a per person basis and have a maximum term of

seven years. The exercise price of these option awards is not less than 100% of the closing price of our stock on the day

prior to the grant date. Option awards granted to employees generally vest over a period of four years for service-based

awards. Certain option awards contain vesting acceleration clauses resulting from events including, but not limited to,

retirement, merger or a similar corporate event.

Stock Awards

Annual grants of stock awards are limited to 400,000 shares on a per person basis. Stock awards granted to employees

generally vest evenly over a period of four years for service-based awards. Certain performance-based awards, which

have variable payout conditions based on predetermined financial targets, vest three years from the date of grant.

Certain stock awards and other agreements contain vesting acceleration clauses resulting from events including, but not

limited to, retirement, merger or a similar corporate event. Stock awards granted to non-employee Board members

generally vest in one year. Non-employee Board members automatically receive stock awards on the date of their

initial election to the Board and annually thereafter on the date of the annual meeting of stockholders (so long as they

continue to serve as a non-employee Board member).

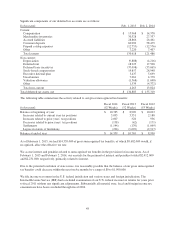

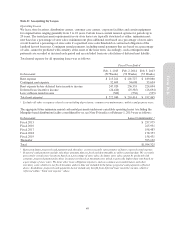

Stock-Based Compensation Expense

We measure and record stock-based compensation expense for all employee stock-based awards using a fair value

based method. During fiscal 2014, fiscal 2013 and fiscal 2012, we recognized total stock-based compensation expense,

as a component of selling, general and administrative expenses, of $44,632,000, $38,788,000 and $31,042,000,

respectively. As of February 1, 2015, there was $52,317,000 of unrecognized stock-based compensation expense (net

of estimated forfeitures), which we expect to recognize on a straight-line basis over a weighted average remaining

service period of approximately two years. At each reporting period, all compensation expense attributable to vested

awards has been fully recognized.

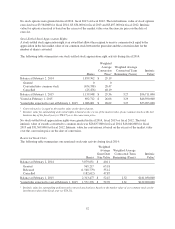

Stock Options

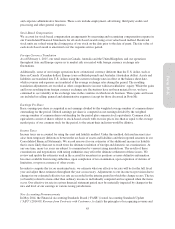

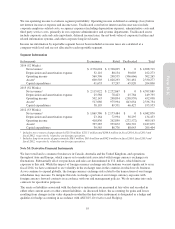

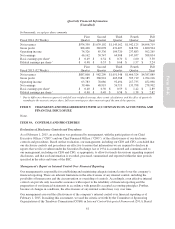

The following table summarizes our stock option activity during fiscal 2014:

Shares

Weighted

Average

Exercise

Price

Weighted Average

Contractual Term

Remaining (Years)

Intrinsic

Value1

Balance at February 2, 2014 (100% vested) 222,488 $ 37.11

Granted 0 0

Exercised (115,488) 35.30

Cancelled 0 0

Balance at February 1, 2015 (100% vested) 107,000 $ 39.05 0.81 $4,194,000

1Intrinsic value for outstanding and vested options is based on the excess of the market value of our common stock on the

last business day of the fiscal year (or $78.25) over the exercise price.

51

Form 10-K