Pottery Barn 2014 Annual Report Download - page 112

Download and view the complete annual report

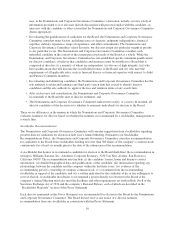

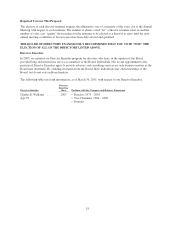

Please find page 112 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our 2000 Nonqualified Stock Option Plan that expired unexercised after March 15, 2006. If this proposal is

approved, then a total of 32,309,903 shares will have been authorized for grant under the amended and restated

Incentive Plan since its inception. As of March 30, 2015, before the addition of shares pursuant to this proposal,

3,411,226 reserved shares were subject to outstanding awards and 4,379,565 reserved shares remained available

for future grant. The 1993 Stock Option Plan and the 2000 Nonqualified Stock Option Plan are no longer used to

grant awards. On March 30, 2015, the closing price of a share of our common stock on the New York Stock

Exchange was $79.11.

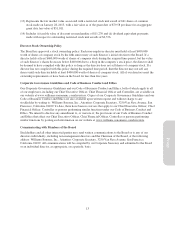

To the extent permitted by stock exchange regulations, awards granted or shares issued by the company in

assumption of, or in substitution or exchange for, prior awards or obligations of any company acquired by or

combined with the company or a subsidiary shall not be added to or reduce the maximum limit on shares

reserved for issuance under the Incentive Plan. In the event that a company acquired by or combined with the

company or a subsidiary has shares available under a pre-existing plan approved by stockholders that was not

adopted in contemplation of the acquisition or combination, to the extent permitted by stock exchange

regulations, the shares available for grant under that pre-existing plan (as adjusted to reflect the acquisition or

combination) may be used for awards under the Incentive Plan, and shall not reduce or be added back to the

number of authorized shares under the Incentive Plan. However, awards using such shares that are available

under any such pre-existing plan (1) shall not be made after the date awards or grants could have been made

under the terms of the pre-existing plan, absent the acquisition or combination, and (2) shall only be made to

individuals who were not eligible for awards under the Incentive Plan prior to the acquisition or combination.

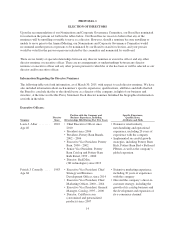

Board Approval of the Amended and Restated Incentive Plan

On March 25, 2015, our Board approved the amended and restated Incentive Plan, subject to approval from our

stockholders at the 2015 Annual Meeting. Our named executive officers and directors have an interest in this

proposal because they are eligible to receive plan awards.

Summary of the Amended and Restated Incentive Plan

The following provides a summary of the principal features of the amended and restated Incentive Plan and its

operation. This summary is qualified in its entirety by the Amended and Restated 2001 Long-Term Incentive

Plan attached as Exhibit A.

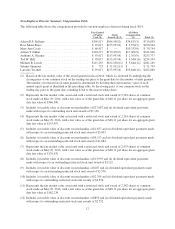

Types of Awards are Available under the Incentive Plan

We may grant the following types of incentive awards under the Incentive Plan: (i) stock options; (ii) restricted

stock; (iii) restricted stock units; (iv) stock appreciation rights that are settled in shares; (v) dividend equivalents;

and (vi) deferred stock awards.

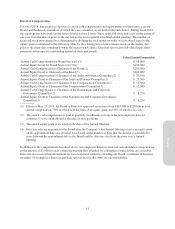

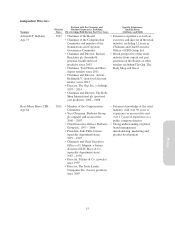

Plan Administration

A committee of at least two non-employee members of our Board administers the Incentive Plan (the

“committee”). To the extent the company wishes to qualify grants as exempt from the short-swing transaction

liability provisions of Section 16 of the Securities Exchange Act, as amended (relating to purchases and sales of

our stock within less than six months), the members of the committee must qualify as “non-employee directors.”

Further, to make grants to our officers or directors, the members of the committee must qualify as “independent

directors” under the applicable requirements and criteria of the New York Stock Exchange. Members of the

committee must also qualify as “outside directors” under Section 162(m) to the extent the company wishes to

potentially receive a federal tax deduction for certain compensation paid under the plan to our Chief Executive

Officer and the next three highest paid employees (other than our principal financial officer). The committee has

delegated its authority under the plan to two members of the Board, but only with respect to grants to certain of

our employees who are not “officers” for purposes of Section 16.

20