Pottery Barn 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

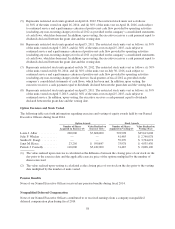

Acceleration of PSUs

As described in the Compensation Discussion and Analysis, PSUs were granted for the first time in fiscal 2014.

The PSUs vest on a pro-rata basis subject to achievement of the applicable performance goals in the event of a

Named Executive Officer’s death, “disability,” or “retirement.” The PSUs also provide that upon a “change in

control,” the performance goals shall be deemed satisfied at target and, for purposes of any severance vesting

provisions, the PSUs will generally be treated in the same manner as a time-based restricted stock unit award

covering the number of shares based on such deemed target performance.

For purposes of the PSUs, “disability” means the occurrence of any of the following events: (i) the executive

being unable to engage in any substantial gainful activity by reason of any medically determinable physical or

mental impairment that can be expected to last for a continuous period of not less than 12 months; (ii) the

executive is, by reason of any medically determinable physical or mental impairment that can be expected to

result in death or can be expected to last for a continuous period of not less than 12 months, receiving income

replacement benefits for a period of not less than three months under the company’s accident and health plan

covering the company’s employees; or (iii) the executive has been determined to be totally disabled by the Social

Security Administration.

For purposes of the PSUs, “retirement” means the executive’s termination of employment for a reason other than

“cause,” “disability,” or death subsequent to the executive having attained age 70 and having been employed by

the company for at least 15 years. Currently, none of the Named Executive Officers satisfy the requirements for

“retirement.”

For purposes of the PSUs, “cause” means: (i) embezzlement, theft or misappropriation by the executive of any

property of any of the company; (ii) the executive’s breach of any fiduciary duty to the company; (iii) the

executive’s failure or refusal to comply with laws or regulations applicable to the company and their businesses

or the policies of the company governing the conduct of its employees or directors; (iv) the executive’s gross

incompetence in the performance of your job duties; (v) the executive’s commission of a felony or of any crime

involving moral turpitude, fraud or misrepresentation; (vi) the executive’s failure to perform duties consistent

with a commercially reasonable standard of care; (vii) the executive’s failure or refusal to perform job duties or

to perform specific directives of the executive’s supervisor or designee, or the senior officers or the Board; or

(viii) any gross negligence or willful misconduct by the executive resulting in loss to the company or, or damage

to the reputation of the company.

For purposes of the PSUs, “change in control” generally has the same meaning of “change in control” under the

EVP Retention Plan or in the Named Executive Officer’s employment agreement, as applicable.

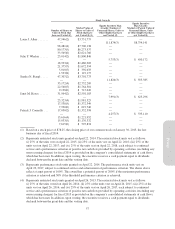

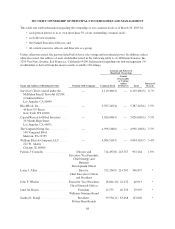

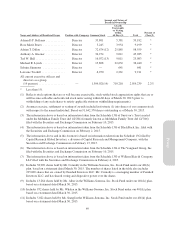

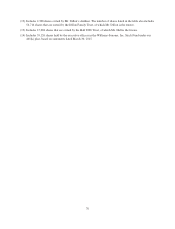

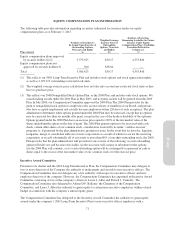

Laura J. Alber

We entered into an amended and restated employment agreement with Laura J. Alber, effective as of

September 6, 2012, which amended and restated the prior agreement entered into with Ms. Alber, effective

May 26, 2010. The employment agreement restates substantially all of the material terms of the prior agreement,

with the exception of extending the term of the agreement through September 7, 2033 and referencing

Ms. Alber’s current base salary of $1,300,000. If we terminate Ms. Alber’s employment without “cause,” if she

terminates her employment with us for “good reason,” or if her employment is terminated due to her death or

“disability,” she will be entitled to receive (i) severance equal to 24 months of her base salary to be paid over

24 months, (ii) a lump sum payment equal to 200% of the average annual bonus received by her in the last

36 months prior to the termination, (iii) in lieu of continued employment benefits (other than as required by law),

payments of $3,000 per month for 18 months, and (iv) accelerated vesting of her then-outstanding equity awards

that vest solely based upon Ms. Alber’s continued service by up to an additional 18 months’ of vesting credit, and

if the awards were subject to cliff-vesting of more than one year, the cliff-vesting provision will be lifted and

vesting credit given as if the award had been subject to monthly vesting, and equity awards subject to

performance-based vesting will remain outstanding through the date upon which the achievement of the

61

Proxy