Pottery Barn 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

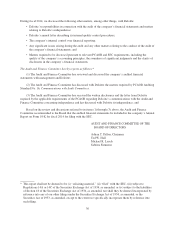

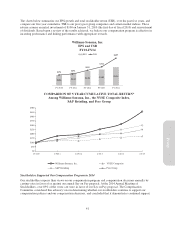

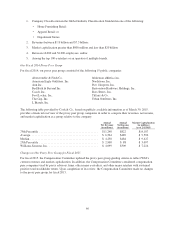

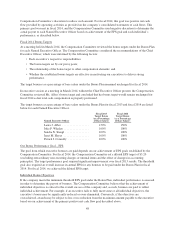

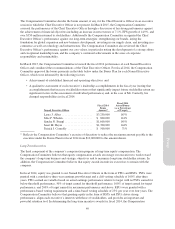

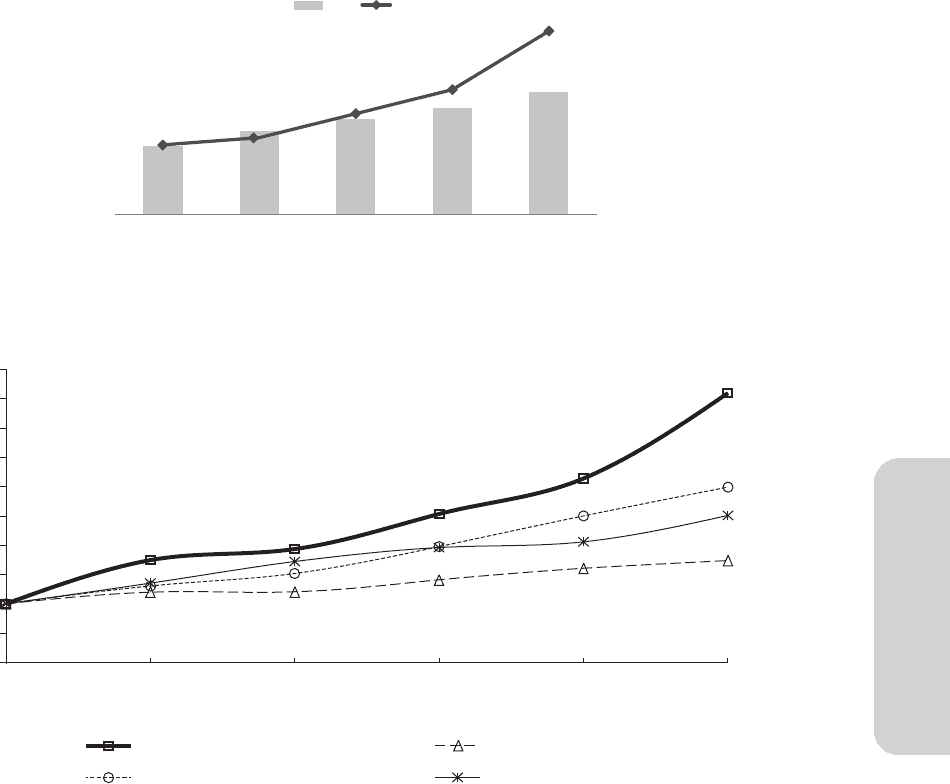

The charts below summarize our EPS growth and total stockholder return (TSR), over the past five years, and

compare our five-year cumulative TSR to our proxy peer group companies and certain market indices. These

returns assume an initial investment of $100 on January 31, 2010 (the first day of fiscal 2010) and reinvestment

of dividends. Based upon a review of the results achieved, we believe our compensation program is effective in

incenting performance and linking performance with appropriate rewards.

$1.83 $2.22 $2.54 $2.82 $3.24

$174 $192

$252

$312

$457

FY 2010 FY 2011 FY 2012 FY 2013 FY 2014

Williams-Sonoma, Inc.

EPS and TSR

FY10-FY14

EPS TSR

1/31/10 1/30/11 1/29/12 2/3/13 2/1/152/2/14

$0

$100

$50

$150

$200

$250

$300

$350

$400

$450

$500

Williams-Sonoma, Inc. NYSE Composite

S&P Retailing Peer Group

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Williams-Sonoma, Inc., the NYSE Composite Index,

S&P Retailing, and Peer Group

Stockholders Supported Our Compensation Program in 2014

Our stockholders express their views on our compensation program and compensation decisions annually by

casting votes in favor of or against our annual Say on Pay proposal. At the 2014 Annual Meeting of

Stockholders, over 89% of the votes cast were in favor of our Say on Pay proposal. The Compensation

Committee considered this advisory vote in determining whether our stockholders continue to support our

compensation policies and our compensation decisions, and concluded that it demonstrates continued support.

41

Proxy