Pottery Barn 2014 Annual Report Download - page 44

Download and view the complete annual report

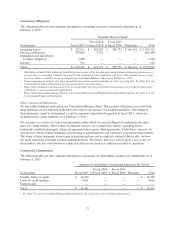

Please find page 44 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2014 vs. Fiscal 2013

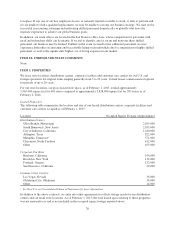

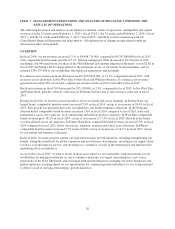

Selling, general and administrative expenses for fiscal 2014 increased by $46,121,000, or 3.7%, compared to

fiscal 2013. Selling, general and administrative expenses as a percentage of net revenues decreased to 27.6% in

fiscal 2014 from 28.5% in fiscal 2013. This decrease as a percentage of net revenues was primarily driven by

greater advertising efficiency, lower general expenses, including litigation settlement income recorded of

$7,414,000, and the leverage of employment costs.

In the e-commerce channel, selling, general and administrative expenses as a percentage of net revenues

decreased in fiscal 2014 compared to fiscal 2013 primarily driven by greater advertising efficiency.

In the retail channel, selling, general and administrative expenses as a percentage of net revenues increased in

fiscal 2014 compared to fiscal 2013 primarily driven by employment cost deleverage, partially offset by lower

general expenses.

Fiscal 2013 vs. Fiscal 2012

Selling, general and administrative expenses for fiscal 2013 increased by $68,805,000, or 5.8%, compared to

fiscal 2012. Including employee separation charges of $2,932,000, selling, general and administrative expenses

as a percentage of net revenues decreased to 28.5% for fiscal 2013 from 29.3% for fiscal 2012 (which included

employee separation charges of $6,935,000 and asset impairment charges of $6,071,000). This decrease as a

percentage of net revenues was primarily driven by greater advertising efficiency due to increasing net revenues,

as well as a reduction in year-over-year asset impairment and employee separation charges.

In the e-commerce channel, selling, general and administrative expenses as a percentage of net revenues

decreased for fiscal 2013 compared to fiscal 2012 primarily driven by greater advertising efficiency due to

increasing net revenues.

In the retail channel, selling, general and administrative expenses as a percentage of net revenues decreased for

fiscal 2013 compared to fiscal 2012 primarily driven by a reduction in year-over-year asset impairment charges

and the leverage of employment costs due to increasing net revenues.

INCOME TAXES

Our effective income tax rate was 38.5% for fiscal 2014, 38.4% for fiscal 2013, and 37.4% for fiscal 2012. The

increase in the effective income tax rate in fiscal 2013 over fiscal 2012 was primarily driven by certain favorable

income tax resolutions and credits in fiscal 2012.

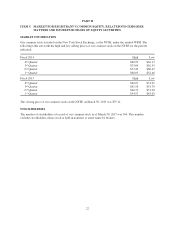

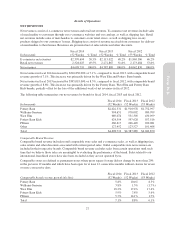

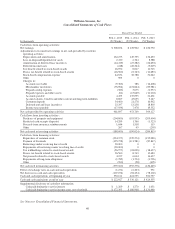

LIQUIDITY AND CAPITAL RESOURCES

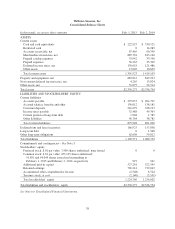

As of February 1, 2015, we held $222,927,000 in cash and cash equivalents, the majority of which is held in

demand deposit accounts, of which $81,124,000 was held by our foreign subsidiaries. As is consistent within our

industry, our cash balances are seasonal in nature, with the fourth quarter historically representing a significantly

higher level of cash than other periods.

Throughout the fiscal year, we utilize our cash balances to build our inventory levels in preparation for our fourth

quarter holiday sales. In fiscal 2015, we plan to use our cash resources to fund our inventory and inventory

related purchases, advertising and marketing initiatives, stock repurchases, dividend payments and purchases of

property and equipment. In addition to our cash balances on hand, we have a $500,000,000 unsecured revolving

line of credit (“credit facility”) that may be used to borrow revolving loans or to request the issuance of letters of

credit. We may, upon notice to the administrative agent, request existing or new lenders to increase the credit

facility by up to $250,000,000, at such lenders’ option, to provide for a total of $750,000,000 of unsecured

revolving credit. During fiscal 2014, we had borrowings of $90,000,000 under the credit facility, all of which

were repaid in the fourth quarter of fiscal 2014. During fiscal 2013, we had no borrowings under the credit

facility.

During fiscal 2014, we redeemed restricted cash deposits of $14,289,000 previously held under collateralized

trust agreements. These deposits, which secured potential liabilities associated with our workers’ compensation

30