Pottery Barn 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

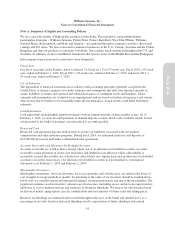

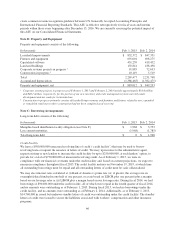

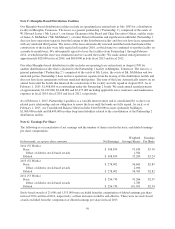

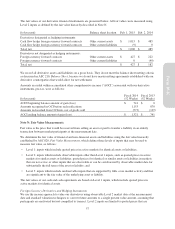

Note F: Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of the estate of

W. Howard Lester (“Mr. Lester”), our former Chairman of the Board and Chief Executive Officer, and the estate

of James A. McMahan (“Mr. McMahan”), a former Director Emeritus and significant stockholder. Partnership 1

does not have operations separate from the leasing of this distribution facility and does not have lease agreements

with any unrelated third parties. The terms of the lease automatically renewed until the bonds that financed the

construction of the facility were fully repaid in December 2010, at which time we continued to rent the facility on

a month-to-month basis. We subsequently agreed to lease the facilities from Partnership 1 through February

2014, at which time the lease was terminated and we vacated the facility. We made annual rental payments of

approximately $28,000 in fiscal 2014, and $618,000 in both fiscal 2013 and fiscal 2012.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of the estate of Mr. Lester, the estate of Mr. McMahan and two

unrelated parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and

does not have lease agreements with any unrelated third parties. The term of the lease automatically renews on an

annual basis until the bonds that financed the construction of the facility are fully repaid in August 2015. As of

February 1, 2015, $1,968,000 was outstanding under the Partnership 2 bonds. We made annual rental payments

of approximately $2,432,000, $2,448,000 and $2,473,000 including applicable taxes, insurance and maintenance

expenses in fiscal 2014, fiscal 2013 and fiscal 2012, respectively.

As of February 1, 2015, Partnership 2 qualifies as a variable interest entity and is consolidated by us due to its

related party relationship and our obligation to renew the lease until the bonds are fully repaid. As such, as of

February 1, 2015, our Consolidated Balance Sheet includes $10,658,000 in assets (primarily buildings),

$1,968,000 in debt and $8,690,000 in other long-term liabilities related to the consolidation of the Partnership 2

distribution facility.

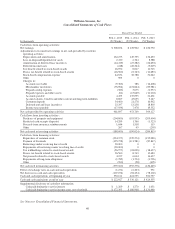

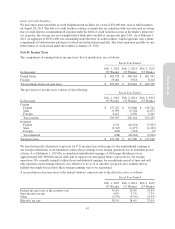

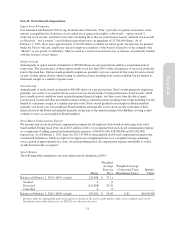

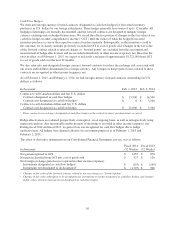

Note G: Earnings Per Share

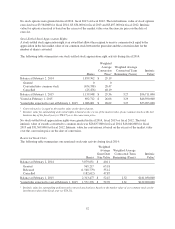

The following is a reconciliation of net earnings and the number of shares used in the basic and diluted earnings

per share computations:

In thousands, except per share amounts Net Earnings

Weighted

Average Shares

Earnings

Per Share

2014 (52 Weeks)

Basic $ 308,854 93,634 $3.30

Effect of dilutive stock-based awards 1,566

Diluted $ 308,854 95,200 $3.24

2013 (52 Weeks)

Basic $ 278,902 96,669 $2.89

Effect of dilutive stock-based awards 2,096

Diluted $ 278,902 98,765 $2.82

2012 (53 Weeks)

Basic $ 256,730 99,266 $2.59

Effect of dilutive stock-based awards 1,785

Diluted $ 256,730 101,051 $2.54

Stock-based awards of 21,000 and 1,313,000 were excluded from the computation of diluted earnings per share

in fiscal 2014 and fiscal 2012, respectively, as their inclusion would be anti-dilutive. There were no stock-based

awards excluded from the computation of diluted earnings per share in fiscal 2013.

50