Pottery Barn 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

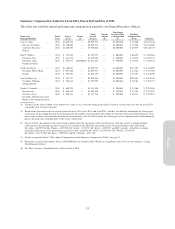

Committee considered relevant market data, the strong performance of the executive team, and in particular the

unvested value of equity awards remaining in fiscal 2014. The Compensation Committee introduced PSUs in

order to provide more at-risk compensation to our Named Executive Officers and to further strengthen the link

between pay and long-term performance. The target number of PSUs granted to our Chief Executive Officer

represented 70% of the total number of equity awards granted in fiscal 2014. For our other Named Executive

Officers, the PSUs represented 20% of the total number of equity awards granted in fiscal 2014. The greater

proportion of PSUs to RSUs for our Chief Executive Officer reflects Ms. Alber’s leadership role in driving our

long-term strategic initiatives.

The Compensation Committee established the three-year earnings growth goals for the PSUs by reference to our

three-year earnings growth plan, which was presented to and reviewed by our Board of Directors. We believe

that the goals were set at challenging levels and are aligned with the long-term interests of our stockholders.

The performance criterion for the fiscal 2014 performance-based RSUs required that the company achieve

positive net cash flow provided by operating activities in fiscal 2014 as provided on the company’s consolidated

statements of cash flows. The performance criterion for fiscal 2014 was achieved.

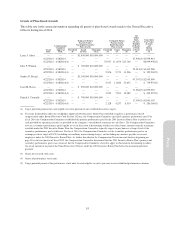

In determining the type and number of equity awards granted to each Named Executive Officer, the

Compensation Committee considered the recommendations of the Chief Executive Officer, which were based on:

• The executive’s performance and contribution to the profitability of the company;

• The type and number of awards previously granted to each executive;

• The executive’s outstanding equity awards;

• The vesting schedule of the executive’s outstanding equity awards;

• The relative value of awards offered by peer companies to executives in comparable positions;

• The appropriate mix between long-term incentive awards and other types of compensation, such as base

salary and bonus; and

• Additional factors, including increased responsibilities, succession planning and retention strategy.

The Compensation Committee believes that each factor influences the type and number of shares appropriate for

each individual and that no one factor is determinative.

In determining the long-term incentive grant for the Chief Executive Officer, the Compensation Committee took

into account a number of factors, including the company’s performance and the assessment by the Compensation

Committee of the Chief Executive Officer’s performance.

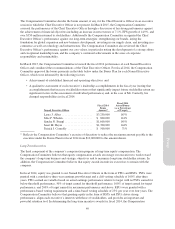

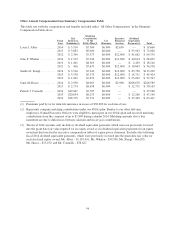

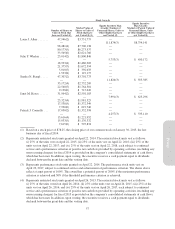

Equity grants approved by the Compensation Committee in April 2014 were as follows:

Named Executive Officer

Number of

Restricted

Stock Units

Number of

Performance

Stock Units

(at Target)

Laura J. Alber ........................ 47,946 111,874

Julie P. Whalen ....................... 23,014 5,753

Sandra N. Stangl ...................... 47,307 11,826

Janet M. Hayes ....................... 31,964 7,991

Patrick J. Connolly .................... 17,030 4,257

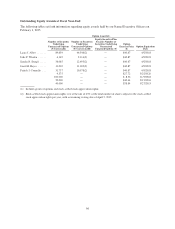

Benefits Provided to Named Executive Officers

All of the benefits offered to our Named Executive Officers are offered broadly to our full-time associates,

except that a limited number of company executives are provided with reimbursement of financial consulting

services up to $12,000 annually. The Compensation Committee believes that providing this assistance is prudent

given the complexity of these executives’ compensation and financial arrangements. The value of the benefits

50