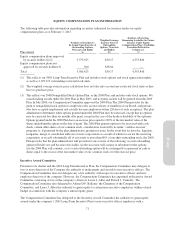

Pottery Barn 2014 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reclassification, stock dividend, extraordinary cash dividend, stock split, reverse stock split or other similar

transaction, the outstanding shares of Stock are increased or decreased or are exchanged for a different number or

kind of shares or other securities of the Company, or additional shares or new or different shares or other

securities of the Company or other non-cash assets are distributed with respect to such shares of Stock or other

securities, subject to the constraints of Code Sections 162(m) and 409A, the Administrator will make an

appropriate or proportionate adjustment in (i) the maximum number of shares reserved for issuance under the

Plan, (ii) the number of Awards that can be granted to any one individual Participant in any calendar year,

(iii) the number and kind of shares or other securities subject to any then outstanding Awards under the Plan, and

(iv) the price for each share subject to any then outstanding Awards under the Plan, without changing the

aggregate exercise price. The adjustment by the Administrator shall be final, binding and conclusive. No

fractional shares of Stock shall be issued under the Plan resulting from any such adjustment.

(d) Substitute Awards. The Administrator may grant Awards under the Plan in substitution for stock and

stock based awards held by employees of another corporation who become employees of the Company or a

Subsidiary as the result of a merger or consolidation of the employing corporation with the Company or a

Subsidiary or the acquisition by the Company or a Subsidiary of property or stock of the employing corporation.

The Administrator may direct that the Substitute Awards be granted with such terms and conditions as the

Administrator considers appropriate in the circumstances. Substitute Awards shall not reduce the shares of Stock

available for issuance under the Plan, nor shall shares subject to a Substitute Award be added back to the shares

of Stock available for issuance under the Plan as provided in Section 3(a) above. Additionally, subject to the

rules of the applicable stock exchange on which the Stock is listed, in the event that a company acquired by the

Company or any Subsidiary or with which the Company or any Subsidiary combines has shares available under a

pre-existing plan approved by stockholders and not adopted in contemplation of such acquisition or combination,

the shares available for grant pursuant to the terms of such pre-existing plan (as adjusted, to the extent

appropriate, using the exchange ratio or other adjustment or valuation ratio or formula used in such acquisition or

combination to determine the consolidation payable to holder of common stock of the entities party to such

acquisition or combination) may be used for Awards under the Plan and shall not reduce the shares available for

issuance under the Plan (and shares subject to such Awards shall not be added back to the shares available for

Awards under the Plan as provided in Section 3(a) above); provided that Awards using such available shares

shall not be made after the date awards or grants could have been made under the terms of the pre-existing plan,

absent the acquisition or combination, and shall only be made to individuals who were not eligible to receive

Awards as set forth in Section 4 below prior to such acquisition or combination.

SECTION 4.

ELIGIBILITY

Those persons eligible to participate in the Plan shall be officers, employees and Non-employee Directors of

the Company, its Parent and any Subsidiaries. Selection of Participants shall be made from time to time by the

Administrator, in its sole discretion.

SECTION 5.

CODE SECTION 162(m) LIMITATIONS

(a) Stock Options and SARs. A Participant can receive no more than one million shares of Stock in the

aggregate covered by Stock Options or SARs during any one calendar year, subject to adjustment under

Section 3(c).

(b) Restricted Stock, Restricted Stock Units and Deferred Stock Awards. A Participant can receive grants

covering no more than one million shares of Stock in the aggregate covered by Restricted Stock, Restricted Stock

Units or Deferred Stock Awards during any one calendar year, subject to adjustment under Section 3(c). Awards

subject to variable payout will be counted at maximum payout for this purpose. For the avoidance of doubt, the

A-7