Pottery Barn 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

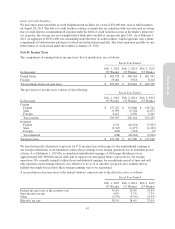

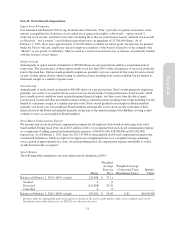

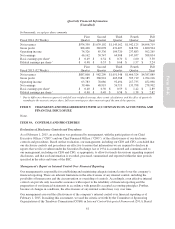

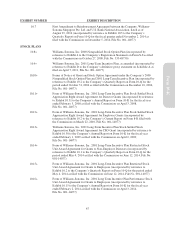

The fair values of our derivative financial instruments are presented below. All fair values were measured using

Level 2 inputs as defined by the fair value hierarchy described in Note N.

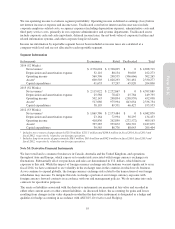

In thousands Balance sheet location Feb. 1, 2015 Feb. 2, 2014

Derivatives designated as hedging instruments:

Cash flow hedge foreign currency forward contracts Other current assets $ 1,015 $ 485

Cash flow hedge foreign currency forward contracts Other current liabilities (9) 0

Total, net $ 1,006 $ 485

Derivatives not designated as hedging instruments:

Foreign currency forward contracts Other current assets $ 427 $ 222

Foreign currency forward contracts Other current liabilities 0 (40)

Total, net $ 427 $ 182

We record all derivative assets and liabilities on a gross basis. They do not meet the balance sheet netting criteria

as discussed in ASC 210, Balance Sheet, because we do not have master netting agreements established with our

derivative counterparties that would allow for net settlement.

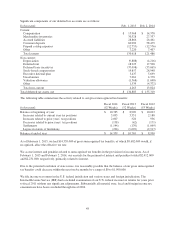

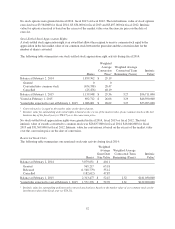

Amounts recorded within accumulated other comprehensive income (“AOCI”) associated with our derivative

instruments, pre-tax, were as follows:

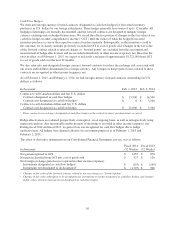

In thousands

Fiscal 2014

(52 Weeks)

Fiscal 2013

(52 Weeks)

AOCI beginning balance amount of gain (loss) $ 741 $ 0

Amounts recognized in OCI before reclassifications 1,153 870

Amounts reclassified from OCI into cost of goods sold (573) (129)

AOCI ending balance amount of gain (loss) $ 1,321 $ 741

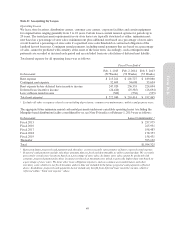

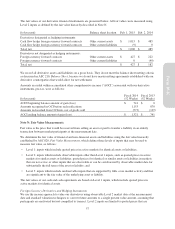

Note N: Fair Value Measurements

Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date.

We determine the fair value of financial and non-financial assets and liabilities using the fair value hierarchy

established by ASC 820, Fair Value Measurement, which defines three levels of inputs that may be used to

measure fair value, as follows:

• Level 1: inputs which include quoted prices in active markets for identical assets or liabilities;

• Level 2: inputs which include observable inputs other than Level 1 inputs, such as quoted prices in active

markets for similar assets or liabilities; quoted prices for identical or similar assets or liabilities in markets

that are not active; or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the asset or liability; and

• Level 3: inputs which include unobservable inputs that are supported by little or no market activity and that

are significant to the fair value of the underlying asset or liability.

The fair values of our cash and cash equivalents are based on Level 1 inputs, which include quoted prices in

active markets for identical assets.

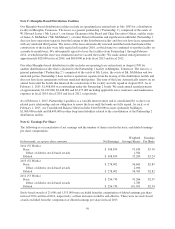

Foreign Currency Derivatives and Hedging Instruments

We use the income approach to value our derivatives using observable Level 2 market data at the measurement

date and standard valuation techniques to convert future amounts to a single present value amount, assuming that

participants are motivated but not compelled to transact. Level 2 inputs are limited to quoted prices that are

57

Form 10-K