Pottery Barn 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

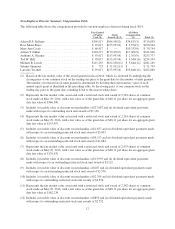

(13) Represents the fair market value associated with a restricted stock unit award of 641 shares of common

stock made on January 28, 2015, with a fair value as of the grant date of $79.58 per share for an aggregate

grant date fair value of $51,011.

(14) Includes (i) taxable value of discount on merchandise of $11,270 and (ii) dividend equivalent payments

made with respect to outstanding restricted stock unit awards of $2,576.

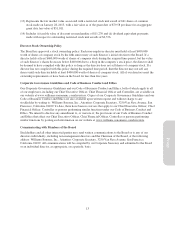

Director Stock Ownership Policy

The Board has approved a stock ownership policy. Each non-employee director must hold at least $400,000

worth of shares of company stock by the fifth anniversary of such director’s initial election to the Board. If a

director holds at least $400,000 worth of shares of company stock during the required time period, but the value

of such director’s shares decreases below $400,000 due to a drop in the company’s stock price, the director shall

be deemed to have complied with this policy so long as the director does not sell shares of company stock. If a

director has not complied with this policy during the required time period, then the director may not sell any

shares until such director holds at least $400,000 worth of shares of company stock. All of our directors meet the

ownership requirements or have been on the board for less than five years.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our Corporate Governance Guidelines and our Code of Business Conduct and Ethics, both of which apply to all

of our employees, including our Chief Executive Officer, Chief Financial Officer and Controller, are available on

our website at www.williams-sonomainc.com/investors. Copies of our Corporate Governance Guidelines and our

Code of Business Conduct and Ethics are also available upon written request and without charge to any

stockholder by writing to: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San

Francisco, California 94109. To date, there have been no waivers that apply to our Chief Executive Officer, Chief

Financial Officer, Controller or persons performing similar functions under our Code of Business Conduct and

Ethics. We intend to disclose any amendment to, or waivers of, the provisions of our Code of Business Conduct

and Ethics that affect our Chief Executive Officer, Chief Financial Officer, Controller or persons performing

similar functions by posting such information on our website at www.williams-sonomainc.com/investors.

Communicating with Members of the Board

Stockholders and all other interested parties may send written communications to the Board or to any of our

directors individually, including non-management directors and the Chairman of the Board, at the following

address: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco,

California 94109. All communications will be compiled by our Corporate Secretary and submitted to the Board

or an individual director, as appropriate, on a periodic basis.

13

Proxy