Pottery Barn 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Flow Hedges

We enter into foreign currency forward contracts designated as cash flow hedges for forecasted inventory

purchases in U.S. dollars by our foreign subsidiaries. These hedges generally have terms of up to 12 months. All

hedging relationships are formally documented, and the forward contracts are designed to mitigate foreign

currency exchange risk on hedged transactions. We record the effective portion of changes in the fair value of our

cash flow hedges in other comprehensive income (“OCI”) until the earlier of when the hedged forecasted

inventory purchase occurs or the respective contract reaches maturity. Subsequently, as the inventory is sold to

the customer, we reclassify amounts previously recorded in OCI to cost of goods sold. Changes in the fair value

of the forward contract related to interest charges or “forward points” are excluded from the assessment and

measurement of hedge effectiveness and are recorded immediately in other income (expense), net. Based on the

rates in effect as of February 1, 2015, we expect to reclassify a net gain of approximately $1,321,000 from OCI

to cost of goods sold over the next 12 months.

We also enter into non-designated foreign currency forward contracts to reduce the exchange risk associated with

our assets and liabilities denominated in a foreign currency. Any foreign exchange gains (losses) related to these

contracts are recognized in other income (expense), net.

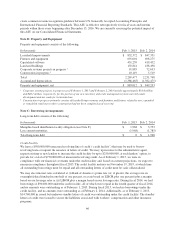

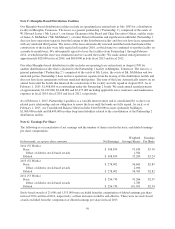

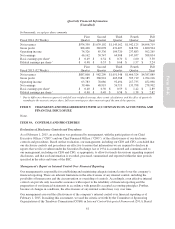

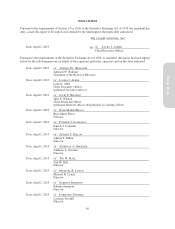

As of February 1, 2015, and February 2, 2014, we had foreign currency forward contracts outstanding (in U.S.

dollars) as follows:

In thousands Feb. 1, 2015 Feb. 2, 2014

Contracts to sell Canadian dollars and buy U.S. dollars

Contracts designated as cash flow hedges $ 15,900 $ 16,500

Contracts not designated as cash flow hedges 1$ 0 $ 3,500

Contracts to sell Australian dollars and buy U.S. dollars

Contracts not designated as cash flow hedges $ 21,000 $ 5,500

1These contracts are no longer designated as cash flow hedges as the related inventory purchases have occurred.

Hedge effectiveness is evaluated prospectively at inception, on an ongoing basis, as well as retrospectively using

regression analysis. Any measureable ineffectiveness of the hedge is recorded in other income (expense), net.

During fiscal 2014 and fiscal 2013, no gain or loss was recognized for cash flow hedges due to hedge

ineffectiveness. All hedges were deemed effective for assessment purposes as of February 1, 2015 and

February 2, 2014.

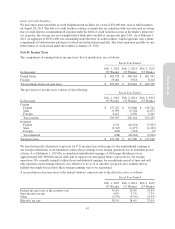

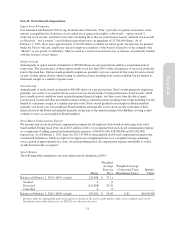

The effect of derivative instruments in our Consolidated Financial Statements, pre tax, was as follows:

In thousands

Fiscal 2014

(52 Weeks)

Fiscal 2013

(52 Weeks)

Net gain recognized in OCI $ 1,153 $ 870

Net gain reclassified from OCI into cost of goods sold $ 573 $ 129

Net foreign exchange gain (loss) recognized in other income (expense):

Instruments designated as cash flow hedges1$ (155) $ (109)

Instruments not designated or de-designated2$ (1,795) $ 906

1Changes in fair value of the forward contract related to interest charges or “forward points.”

2Changes in fair value subsequent to de-designation for instruments no longer designated as cash flow hedges, and changes

in fair value related to instruments not designated as cash flow hedges.

56