Pottery Barn 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

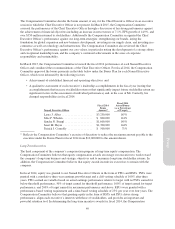

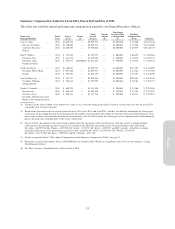

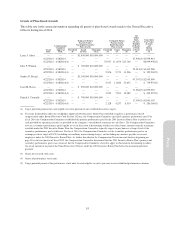

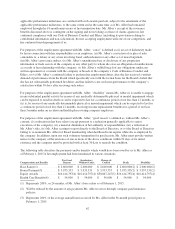

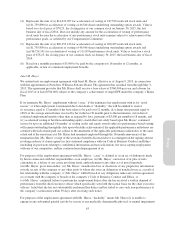

Stock Awards

Number of Shares or

Units of Stock that

have not Vested (#)

Market Value of

Shares or Units of

Stock that have

not Vested ($)(1)

Equity Incentive Plan

Awards: Number of

Unearned Shares, Units or

Other Rights that have

not Vested (#)

Equity Incentive

Plan Awards:

Market or Payout Value of

Unearned Shares, Units

or Other Rights that have

not Vested ($)

Laura J. Alber ....... 47,946(2) $3,751,775 — —

— — 111,874(3) $8,754,141

98,481(4) $7,706,138 — —

80,173(5) $6,273,537 — —

33,505(6) $2,621,766 — —

Julie P. Whalen ...... 23,014(2) $1,800,846

— — 5,753(3) $ 450,172

18,993(4) $1,486,202 — —

21,375(7) $1,672,594 — —

5,010(5) $ 392,033 — —

1,523(8) $ 119,175 — —

Sandra N. Stangl ..... 47,307(2) $3,701,773 — —

— — 11,826(3) $ 925,385

35,172(4) $2,752,209 — —

22,548(5) $1,764,381 — —

9,138(6) $ 715,049 — —

Janet M. Hayes ...... 31,964(2) $2,501,183 — —

— — 7,991(3) $ 625,296

25,323(4) $1,981,525 — —

17,538(5) $1,372,349 — —

7,920(6) $ 619,740 — —

Patrick J. Connolly . . . 17,030(2) $1,332,598 — —

— — 4,257(3) $ 333,110

15,616(4) $1,221,952 — —

15,033(5) $1,176,332 — —

7,615(6) $ 595,874 — —

(1) Based on a stock price of $78.25, the closing price of our common stock on January 30, 2015, the last

business day of fiscal 2014.

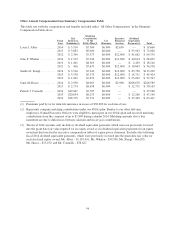

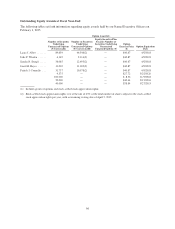

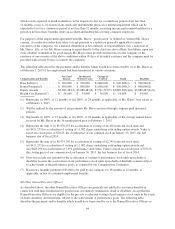

(2) Represents restricted stock units granted on April 22, 2014. The restricted stock units vest as follows:

(i) 25% of the units vest on April 22, 2015; (ii) 25% of the units vest on April 22, 2016; (iii) 25% of the

units vest on April 22, 2017; and (iv) 25% of the units vest on April 22, 2018, each subject to continued

service and a performance criterion of positive net cash flow provided by operating activities (excluding any

non-recurring charges) for fiscal 2014 as provided on the company’s consolidated statements of cash flows,

which has been met. In addition, upon vesting, the executive receives a cash payment equal to dividends

declared between the grant date and the vesting date.

(3) Represents performance stock units granted on April 22, 2014. The performance stock units vest on

April 22, 2017, subject to continued service and achievement of performance criterion. The shares above

reflect a target payout of 100%. This award has a potential payout of 200% if the maximum performance

criterion is achieved and 50% if the threshold performance criterion is achieved.

(4) Represents restricted stock units granted on April 26, 2013. The restricted stock units vest as follows:

(i) 25% of the units vested on April 26, 2014; (ii) 25% of the units vest on April 26, 2015; (iii) 25% of the

units vest on April 26, 2016; and (iv) 25% of the units vest on April 26, 2017, each subject to continued

service and a performance criterion of positive net cash flow provided by operating activities (excluding any

non-recurring charges) for fiscal 2013 as provided on the company’s consolidated statements of cash flows,

which has been met. In addition, upon vesting, the executive receives a cash payment equal to dividends

declared between the grant date and the vesting date.

57

Proxy