Pottery Barn 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

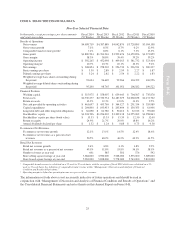

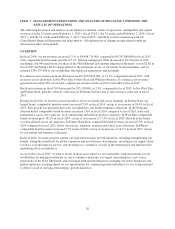

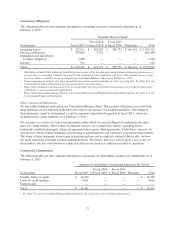

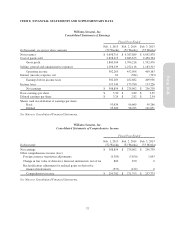

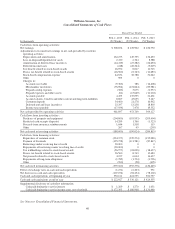

Contractual Obligations

The following table provides summary information concerning our future contractual obligations as of

February 1, 2015:

Payments Due by Period1

In thousands Fiscal 2015

Fiscal 2016

to Fiscal 2018

Fiscal 2019

to Fiscal 2020 Thereafter Total

Operating leases2$ 237,975 $ 602,787 $ 289,372 $ 464,191 $ 1,594,325

Purchase obligations3792,816 9,792 — — 802,608

Memphis-based distribution

facilities obligation41,968 — — — 1,968

Interest 191 — — — 191

Total $ 1,032,950 $ 612,579 $ 289,372 $ 464,191 $ 2,399,092

1This table excludes $16.8 million of liabilities for unrecognized tax benefits associated with uncertain tax positions as we

are not able to reasonably estimate when and if cash payments for these liabilities will occur. This amount, however, has

been recorded as a liability in our accompanying Consolidated Balance Sheet as of February 1, 2015.

2Projected payments include only those amounts that are fixed and determinable as of the reporting date. See Note E to our

Consolidated Financial Statements for discussion of our operating leases.

3Represents estimated commitments at year-end to purchase inventory and other goods and services in the normal course

of business to meet operational requirements.

4Represents bond-related debt pertaining to the consolidation of our Memphis-based distribution facility. See Note F to our

Consolidated Financial Statements.

Other Contractual Obligations

We have other liabilities reflected in our Consolidated Balance Sheet. The payment obligations associated with

these liabilities are not reflected in the table above due to the absence of scheduled maturities. The timing of

these payments cannot be determined, except for amounts estimated to be payable in fiscal 2015, which are

included in our current liabilities as of February 1, 2015.

We are party to a variety of contractual agreements under which we may be obligated to indemnify the other

party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

may provide certain routine indemnification relating to representations and warranties or personal injury matters.

The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we have

not made significant payments for these indemnifications. We believe that if we were to incur a loss in any of

these matters, the loss would not have a material effect on our financial condition or results of operations.

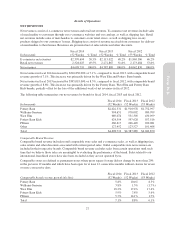

Commercial Commitments

The following table provides summary information concerning our outstanding commercial commitments as of

February 1, 2015:

Amount of Outstanding Commitment Expiration By Period1

In thousands Fiscal 2015

Fiscal 2016

to Fiscal 2018

Fiscal 2019

to Fiscal 2020 Thereafter Total

Standby letters of credit $ 14,760 — — — $ 14,760

Letter of credit facilities 9,651 — — — 9,651

Credit facility — — — — —

Total $ 24,411 — — — $ 24,411

1See Note C to our Consolidated Financial Statements for discussion of our borrowing arrangements.

32