Pottery Barn 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

option or stock appreciation right having an exercise price that exceeds the fair market value of the underlying

stock in exchange for a new award (including a stock option or stock appreciation right), cash, other

consideration, or a combination thereof, without prior consent from our stockholders.

Recoupment of Awards

Under the plan, awards are subject to recoupment in accordance with applicable law and any recoupment policy

adopted by us from time to time.

Specific Benefits Granted under the Amended and Restated Incentive Plan

The amount and timing of awards granted under the plan are determined in the sole discretion of the committee

and therefore cannot be determined in advance. Except for the automatic grants to non-employee directors,

described above, the future awards that would be received under the plan by executive officers and other

employees are discretionary and are therefore not determinable at this time. If the proposed amendment of the

plan had been in effect for our fiscal year ended February 1, 2015, we do not expect that the number of shares

granted to participants under the plan during that year would have been materially different than the number of

shares granted as set forth in the table below. The primary changes to the amended and restated Incentive Plan

that will be made pursuant to this proposal include an increase to the shares issuable under the plan by 6,550,000

shares and an extension of the term of the plan to 2025. We also are asking stockholders to approve the material

terms of the plan.

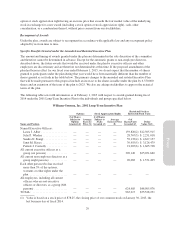

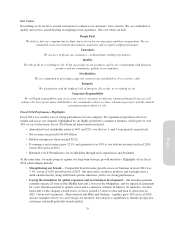

The following table sets forth information as of February 1, 2015 with respect to awards granted during fiscal

2014 under the 2001 Long-Term Incentive Plan to the individuals and groups specified below.

Williams-Sonoma, Inc. 2001 Long-Term Incentive Plan

Options Stock Appreciation Rights

Restricted Stock or

Restricted Stock Units

Name and Position

# of Shares

Subject to

Options

Granted (#)

Average

Exercise

Price ($)

# of Shares

Subject to

SARs

Granted (#)

Average

Exercise Price

($)

#of

Shares/Units

Granted (#)

Dollar

Value ($)(1)

Named Executive Officers:

Laura J. Alber .................. — — — — 159,820(2) $12,505,915

Julie P. Whalen ................. — — — — 28,767(3) $ 2,251,018

Sandra N. Stangl ................ — — — — 59,133(4) $ 4,627,157

Janet M. Hayes ................. — — — — 39,955(5) $ 3,126,479

Patrick J. Connolly .............. — — — — 21,287(6) $ 1,665,708

All current executive officers as a

group (six persons) .............. — — — — 320,149 $25,051,660

All current non-employee directors as a

group (eight persons) ............ — — — — 20,083 $ 1,571,495

Each other person who has received

more than 5% of the options,

warrants or other rights under the

plan .......................... — — — — — —

All employees, including all current

officers who are not executive

officers or directors, as a group (646

persons) ....................... — — — — 624,985 $48,905,076

TOTAL: ........................ — — — — 965,217 $75,528,231

(1) Value is based on a stock price of $78.25, the closing price of our common stock on January 30, 2015, the

last business day of fiscal 2014.

29

Proxy