Pottery Barn 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

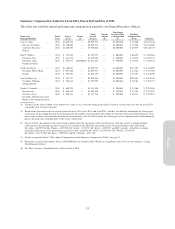

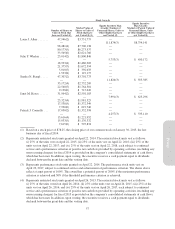

offered to each of the Named Executive Officers is detailed in the Other Annual Compensation from Summary

Compensation Table on page 54. As noted previously, the company does not provide any income tax gross-ups to

Named Executive Officers on any benefits.

Additional Information

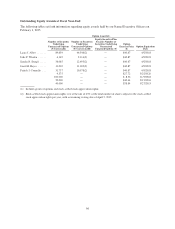

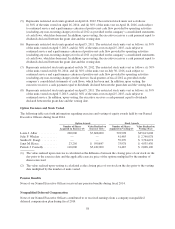

Executive Stock Ownership Guidelines

The Compensation Committee has established stock ownership guidelines for our Named Executive Officers,

among others. Executive stock ownership supports the company’s primary objective of creating long-term value

for stockholders by aligning the executives’ interests directly with those of the company’s stockholders. Each

executive is expected to maintain this minimum ownership while employed with us. Effective March 2015, the

guideline for stock ownership for the Named Executive Officers and certain other executives, other than the

Chief Executive Officer, was increased from one times base salary to two times base salary. The current

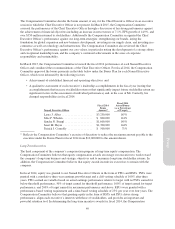

guidelines for stock ownership are:

President and Chief Executive Officer: Five times Base Salary

Other Named Executive Officers: Two times Base Salary

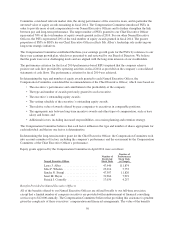

The following equity holdings count toward the stock ownership guidelines: shares directly owned by the

executive or his or her immediate family members; shares held in trust or any similar entity benefiting the

executive or the executive’s immediate family; and shares owned through the Williams-Sonoma, Inc. 401(k)

Plan. Unexercised stock appreciation rights, unexercised stock options, and unvested restricted stock units or

other full-value awards do not count towards the stock ownership guidelines listed above.

Executives covered under the ownership guidelines are required to retain at least 50% of the net after-tax shares

received as a result of the release of restricted stock units until the applicable ownership guideline has been

achieved. All of our Named Executive Officers meet or exceed the revised stock ownership guidelines or comply

with the stock retention requirements for vested restricted stock units that are designed to bring the executive up

to the applicable ownership level.

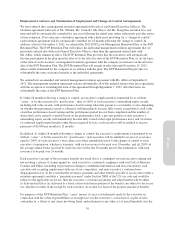

Double-Trigger Change of Control Provisions

Each of our Named Executive Officers is entitled to double-trigger change of control benefits under either a

Management Retention Agreement or our 2012 EVP Level Management Retention Plan, other than our Chief

Executive Officer, who is entitled to such benefits under an individual arrangement. None of our Named

Executive Officers are provided with any type of golden parachute excise tax gross-up. We believe that our

change of control arrangements are competitive compensation practices and meet the company’s objectives of:

• Enhancing our ability to retain these key executives as such arrangements are an important component of

competitive compensation programs;

• Ensuring that our executives remain objective and fully dedicated to the company’s business and strategic

objectives at a critical time; and

• Facilitating a smooth transition should a change in control occur.

The Compensation Committee has considered the total potential cost of the change of control arrangements

provided to our Named Executive Officers and has determined that such cost is reasonable and reflects the

importance of the objectives described above.

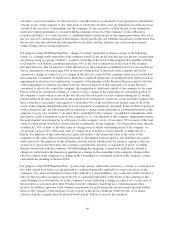

Severance Protection for the Chief Executive Officer

As described in the section titled “Employment Contracts and Termination of Employment and Change-of-

Control Arrangements” beginning on page 59, we have entered into a severance arrangement with Ms. Alber

providing for certain severance benefits following a change of control in the event of a termination of her

employment without cause or her voluntary termination for good reason. The Compensation Committee

51

Proxy