Pottery Barn 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

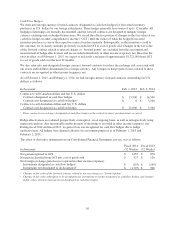

Letter of Credit Facilities

We have three unsecured letter of credit reimbursement facilities for a total of $70,000,000, each of which matures

on August 28, 2015. The letter of credit facilities contain covenants that are consistent with our unsecured revolving

line of credit. Interest on unreimbursed amounts under the letter of credit facilities accrues at the lender’s prime rate

(or, if greater, the average rate on overnight federal funds plus one-half of one percent) plus 2.0%. As of February 1,

2015, an aggregate of $9,651,000 was outstanding under the letter of credit facilities, which represents only a future

commitment to fund inventory purchases to which we had not taken legal title. The latest expiration possible for any

future letters of credit issued under the facilities is January 25, 2016.

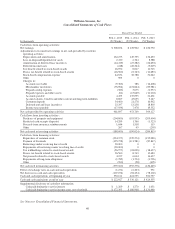

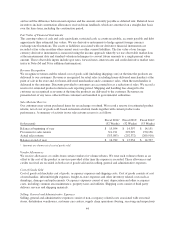

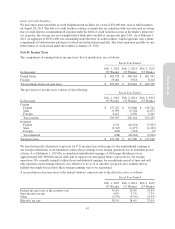

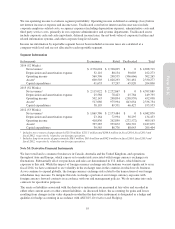

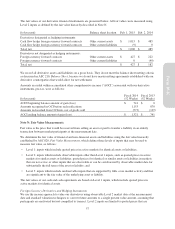

Note D: Income Taxes

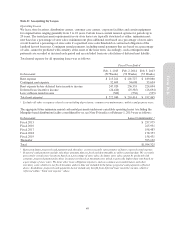

The components of earnings before income taxes, by tax jurisdiction, are as follows:

Fiscal Year Ended

In thousands

Feb. 1, 2015

(52 Weeks)

Feb. 2, 2014

(52 Weeks)

Feb. 3, 2013

(53 Weeks)

United States $ 482,739 $ 448,764 $ 401,542

Foreign 19,464 3,918 8,414

Total earnings before income taxes $ 502,203 $ 452,682 $ 409,956

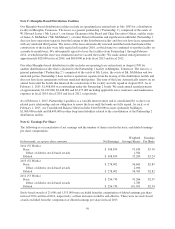

The provision for income taxes consists of the following:

Fiscal Year Ended

In thousands

Feb. 1, 2015

(52 Weeks)

Feb. 2, 2014

(52 Weeks)

Feb. 3, 2013

(53 Weeks)

Current

Federal $ 157,227 $ 173,686 $ 136,742

State 31,959 25,748 22,072

Foreign 4,411 2,690 3,441

Total current 193,597 202,124 162,255

Deferred

Federal 2,719 (26,324) (7,827)

State (2,547) (1,277) (1,202)

Foreign (420) (743) (0)

Total deferred (248) (28,344) (9,029)

Total provision $ 193,349 $ 173,780 $ 153,226

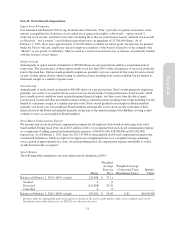

We have historically elected not to provide for U.S. income taxes with respect to the undistributed earnings of

our foreign subsidiaries as we intended to utilize those earnings in our foreign operations for an indefinite period

of time. As of February 1, 2015 the accumulated undistributed earnings of all foreign subsidiaries were

approximately $43,300,000 and are sufficient to support our anticipated future cash needs for our foreign

operations. We currently intend to utilize those undistributed earnings for an indefinite period of time and will

only repatriate such earnings when it is tax effective to do so. It is currently not practical to estimate the tax

liability that might be payable if these foreign earnings were to be repatriated.

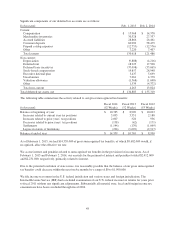

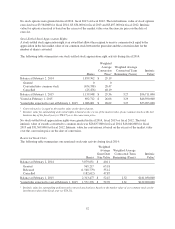

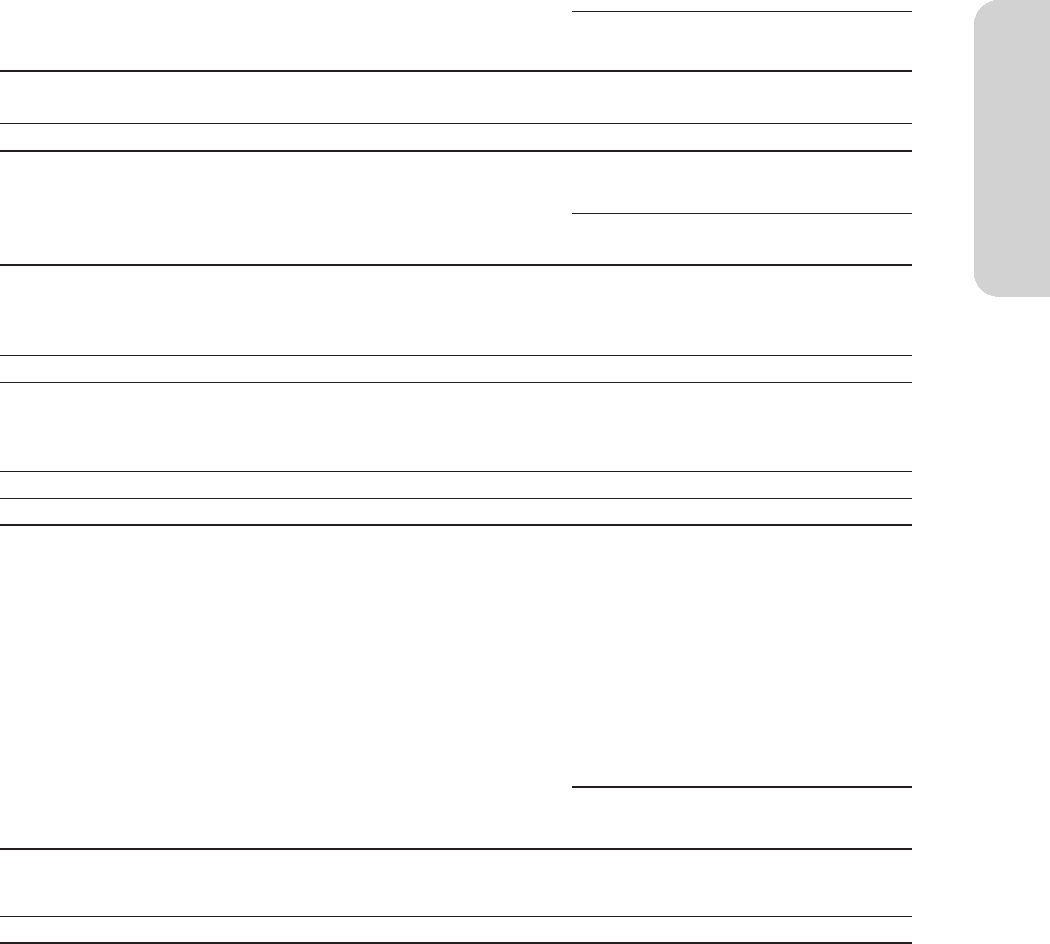

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Feb. 1, 2015

(52 Weeks)

Feb. 2, 2014

(52 Weeks)

Feb. 3, 2013

(53 Weeks)

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate 4.0% 3.7% 3.3%

Other (0.5%) (0.3%) (0.9%)

Effective tax rate 38.5% 38.4% 37.4%

47

Form 10-K