Pottery Barn 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

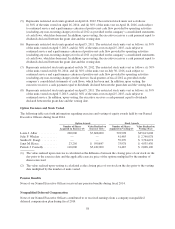

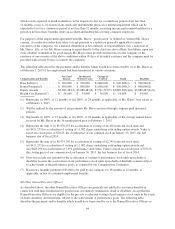

of February 1, 2015 under the EVP Retention Plan (and individual agreements) if within 18 months following a

change of control of the company, the executive’s employment was terminated by us without cause, or by the

executive for good reason.

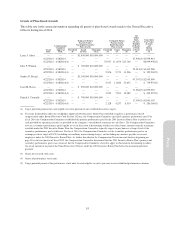

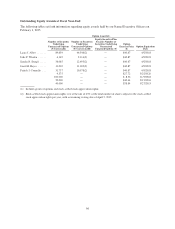

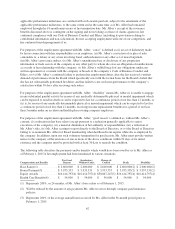

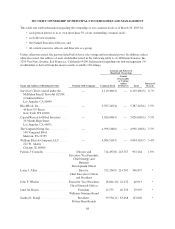

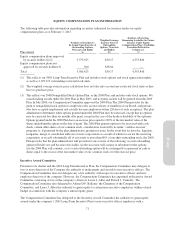

Potential Double-Trigger Change in Control Benefits

Name Base Salary(1) Bonus Payment(2)

Equity

Awards(3)(4)

Health Care

Benefits(5)

Julie P. Whalen ......................... $1,400,000 $1,233,333 $ 6,000,117(6) $36,000

Sandra N. Stangl ........................ $2,200,000 $3,066,667 $10,333,335(7) $36,000

Patrick J. Connolly ...................... $1,400,000 $1,433,333 $ 5,055,271(8) $36,000

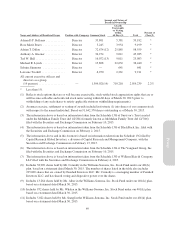

(1) Represents 200% of each Named Executive Officer’s base salary as of February 1, 2015.

(2) Represents 200% of the average annual bonus received by each Named Executive Officer in the 36-month

period prior to February 1, 2015.

(3) Value is based on a stock price of $78.25, the closing price of our common stock on January 30, 2015, the

last business day of fiscal 2014.

(4) Does not include any amount for the acceleration of vesting of performance stock units upon death or

disability since the acceleration of any performance stock units upon death or disability remains subject to

achievement of the performance goals, as certified by our Compensation Committee.

(5) Based on a monthly payment of $3,000 to be paid by the company for 12 months in lieu of continued

employment benefits.

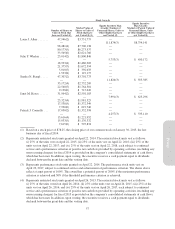

(6) Represents the sum of (i) $5,470,849 for acceleration of vesting of 69,915 restricted stock units, (ii) $79,096

for acceleration of vesting of 2,116 shares underlying outstanding option awards and (iii) $450,172 for

acceleration of vesting of 5,753 performance stock units.

(7) Represents the sum of (i) $8,933,411 for acceleration of vesting of 114,165 restricted stock units,

(ii) $474,539 for acceleration of vesting of 12,695 shares underlying outstanding option awards and

(iii) $925,385 for acceleration of vesting of 11,826 performance stock units.

(8) Represents the sum of (i) $4,326,755 for acceleration of vesting of 55,294 restricted stock units,

(ii) $395,406 for acceleration of vesting of 10,578 shares underlying outstanding option awards and

(iii) $333,110 for acceleration of vesting of 4,257 performance stock units.

65

Proxy