Pottery Barn 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

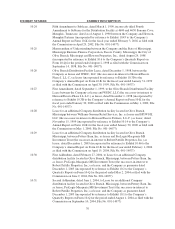

EXHIBIT NUMBER EXHIBIT DESCRIPTION

10.32 Lease for Company distribution facility on the East Coast located in Cranbury, New

Jersey between Williams-Sonoma Direct, Inc. and Keystone Cranbury East, LLC,

effective as of February 2, 2004 (incorporated by reference to Exhibit 10.1 to the

Company’s Quarterly Report on Form 10-Q for the period ended May 2, 2004 as filed

with the Commission on June 9, 2004, File No. 001-14077)

EMPLOYMENT AGREEMENTS

10.33+ Employment Agreement between the Company and Laura Alber, dated March 19,

2001 (incorporated by reference to Exhibit 10.77 to the Company’s Annual Report on

Form 10-K for the fiscal year ended February 3, 2002 as filed with the Commission

on April 29, 2002, File No. 001-14077)

10.34+ Employment Agreement between the Company and Sharon McCollam, dated

December 28, 2002 (incorporated by reference to Exhibit 10.42 to the Company’s

Annual Report on Form 10-K for the fiscal year ended January 30, 2005 as filed with

the Commission on April 15, 2005, File No. 001-14077)

OTHER AGREEMENTS

10.35# Aircraft Purchase Agreement, dated April 30, 2003, between the Company as buyer

and Bombardier Inc. as seller (incorporated by reference to Exhibit 10.40 to the

Company’s Annual Report on Form 10-K for the fiscal year ended February 1, 2004

as filed with the Commission on April 15, 2004, File No. 001-14077)

10.36# Services Agreement, dated September 30, 2004, by and between the Company and

International Business Machines Corporation (incorporated by reference to Exhibit

10.1 to the Company’s Quarterly Report on Form 10-Q for the period ended October

31, 2004 as filed with the Commission on December 10, 2004, File No. 001-14077)

OTHER EXHIBITS

21.1* Subsidiaries

23.1* Consent of Independent Registered Public Accounting Firm

CERTIFICATIONS

31.1* Certification of Chief Executive Officer, pursuant to Rule 13a-14(a) and Rule

15d-14(a) of the Securities Exchange Act, as amended

31.2* Certification of Chief Financial Officer, pursuant to Rule 13a-14(a) and Rule

15d-14(a) of the Securities Exchange Act, as amended

32.1* Certification of Chief Executive Officer, pursuant to 18 U.S.C. Section 1350, as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

32.2* Certification of Chief Financial Officer, pursuant to 18 U.S.C. Section 1350, as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

* Filed herewith.

+ Indicates a management contract or compensatory plan or arrangement.

# We have requested confidential treatment on certain portions of this exhibit from the SEC. The omitted portions have been

filed separately with the SEC.

71

Form 10-K