Pottery Barn 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

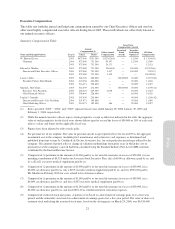

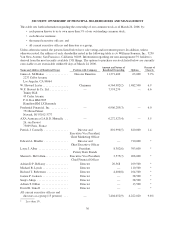

other employees to increase shareholder value over the long term. We granted stock options to each of the named

executive officers and restricted stock unit awards to certain of the named executive officers in fiscal 2005. Our

equity awards to executive officers are designed to be competitive with those offered by comparable companies

for an executive’s job level, to reflect the company’s assessment of the executive’s ongoing contributions to the

company, to create an incentive for executives to remain with the company, and/or to provide a long-term

incentive to help the company achieve its financial and strategic objectives. Our restricted stock unit awards to

executive officers will vest only if the company achieves certain earnings goals. A portion vests based on

achievement of earnings goals over a four-year period, and the remainder vests based on achievement of earnings

goals over a five-year period. Annual equity compensation awards to our executive officers fall generally within

the third quartile of equity awards to similarly situated executive officers at comparable companies.

In determining the type and number of equity awards granted to an individual executive, the Compensation

Committee considered such factors as:

• Awards previously granted to an individual;

• An individual’s outstanding awards;

• The vesting schedule of the individual’s outstanding awards;

• The aggregate total of all outstanding awards;

• The relative value of awards offered by comparable companies to executives in comparable positions; and

• Additional factors, including succession planning and retention of the company’s high potential

executives.

We may grant or approve special additional equity awards from time to time to executive officers in connection

with promotions, assumption of additional responsibilities and other factors.

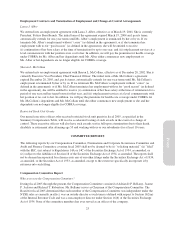

Under the company’s existing equity compensation plans, the exercise price of any stock option or stock

appreciation right may not be less than 100% of the fair market value of the stock (based on the price of the

company’s common stock on the date of the award). Equity awards granted pursuant to the company’s equity

compensation plans generally vest in five equal annual installments. It is the company’s policy not to reprice

stock options or stock appreciation rights in the event that the fair market value of the common stock falls below

the exercise price of the stock options or stock appreciation rights and not to engage in any exchange program

relating to stock options or stock appreciation rights without obtaining prior shareholder approval. Our 2001

Long-Term Incentive Plan, as set forth in Proposal 2, prohibits such repricings or exchanges unless our

shareholders approve them in advance. If Proposal 2 is approved by our shareholders, we will only make future

awards under our 2001 Long-Term Incentive Plan. Restricted stock units granted under the company’s 2001

Long-Term Incentive Plan have to date been structured so as to vest and be paid out only upon achievement of

specific goals relating to company earnings over four and five-year periods.

How is the Chief Executive Officer compensated?

We determined Edward A. Mueller’s compensation package based in part on:

• A review of the compensation paid to chief executive officers of comparable companies (based on the

process described above);

• Company performance; and

• Our general compensation philosophy as described above.

Mr. Mueller’s compensation package for fiscal 2005 included a base salary of $975,000 and a bonus of $731,300.

The bonus portion of Mr. Mueller’s compensation was based on a formula linked to the company’s earnings

performance and Mr. Mueller’s individual performance. As noted previously, Mr. Mueller was paid a full bonus

27

Proxy