Pottery Barn 2005 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SECTION 2.

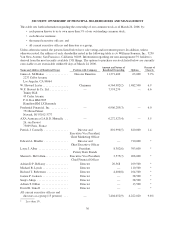

ADMINISTRATION OF PLAN; ADMINISTRATOR AUTHORITY TO SELECT

PARTICIPANTS AND DETERMINE AWARDS

(a) Committee. The Plan shall be administered by a committee of not fewer than two (2) Non-employee

Directors (the “Administrator”). To the extent desirable to qualify transactions hereunder as exempt under

Rule 16b-3, each member of the Committee shall be a “non-employee director” within the meaning of Rule 16b-

3(b)(3)(i) promulgated under the Exchange Act, or any successor definition. To the extent that the Administrator

determines it to be desirable to qualify Awards granted hereunder as “performance-based compensation” within

the meaning of Section 162(m) of the Code, each member of the Committee shall also be an “outside director”

within the meaning of Section 162(m) of the Code and the regulations (including temporary and proposed

regulations) promulgated thereunder. In addition, each member of the Committee shall meet the then applicable

requirements and criteria of the New York Stock Exchange (or other market on which the Stock then trades) for

qualification as an “independent director.”

(b) Delegation by the Administrator. The Administrator, in its sole discretion and on such terms and

conditions as it may provide, may delegate all or any part of its authority and powers under the Plan to two or

more Directors of the Company; provided, however, that the Administrator may not delegate its authority and

powers (a) with respect to any person who, with respect to the Stock, is subject to Section 16 of the Exchange

Act, or (b) in any way which would jeopardize the Plan’s qualification under Applicable Laws.

(c) Powers of Administrator. The Administrator shall have the power and authority to grant Awards

consistent with the terms of the Plan, including the power and authority:

(i) to select the individuals to whom Awards may from time to time be granted;

(ii) to determine the time or times of grant, and the extent, if any, of Incentive Stock Options,

Non-Qualified Stock Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights,

Dividend Equivalents and Deferred Stock Awards, or any combination of the foregoing, granted to any one

or more Participants;

(iii) to determine the number of shares of Stock to be covered by any Award;

(iv) to determine and modify from time to time the terms and conditions, including restrictions,

consistent with the terms of the Plan, of any Award, which terms and conditions may differ among

individual Awards and Participants, and to approve the form of written instruments evidencing the Awards;

(v) subject to the minimum vesting provisions of Sections 8(d), 9(d) and 10(a), to accelerate at any

time the exercisability or vesting of all or any portion of any Award;

(vi) subject to the provisions of Sections 6(a)(iii) and 7(a)(iii), to extend at any time the post-

termination period in which Stock Options or Stock Appreciations Rights may be exercised;

(vii) to determine at any time whether, to what extent, and under what circumstances Stock and other

amounts payable with respect to an Award shall be deferred either automatically or at the election of the

Participant and whether and to what extent the Company shall pay or credit amounts constituting deemed

interest (at rates determined by the Administrator) or dividends or deemed dividends on such deferrals;

(viii) to develop, approve and utilize forms of notices, Award Agreements and similar materials for

administration and operation of the Plan;

(ix) to determine if any Award shall be accompanied by the grant of a corresponding Dividend

Equivalent; and

(x) at any time to adopt, alter and repeal such rules, guidelines and practices for administration of the

Plan and for its own acts and proceedings as the Administrator shall deem advisable; to interpret the terms

A-4