Pottery Barn 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

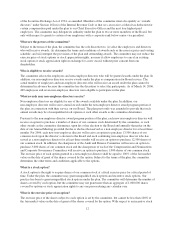

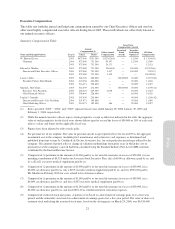

(10) Comprised of (i) premiums in the amount of $1,000 paid by us for term life insurance in excess of $50,000, (ii) our

matching contribution of $4,325 under our Associate Stock Incentive Plan, (iii) a $6,000 car allowance paid by us, and

(iv) a $830 executive medical supplement paid by us.

(11) Comprised of (i) premiums in the amount of $1,000 paid by us for term life insurance in excess of $50,000, (ii) our

matching contribution of $4,239 under our Associate Stock Incentive Plan, (iii) a $6,000 car allowance paid by us, and

(iv) a $2,500 executive medical supplement paid by us.

(12) Comprised of (i) premiums in the amount of $1,000 paid by us for term life insurance in excess of $50,000, (ii) our

matching contribution of $3,332 under our Associate Stock Incentive Plan, (iii) a $6,000 car allowance paid by us, and

(iv) a $1,198 executive medical supplement paid by us.

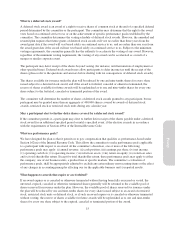

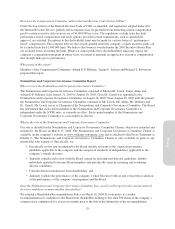

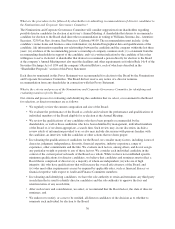

Option Grants in Fiscal 2005

This table sets forth certain information regarding all stock option grants made to the named executive officers

during fiscal 2005.

Individual Grants Potential Realized

Value at Assumed Annual

Rates of Stock Price

Appreciation for Option

Term(3)

Number of

Securities

Underlying

Options

Granted

Percentage of

Total Options

Granted to

Employees in

Fiscal Year(1)

Exercise or

Base Price

Per Share

Expiration

Date(2)Name 5% 10%

W. Howard Lester ............. 12,500 0.71% $38.84 5/27/2015 $ 305,328 $ 773,762

Edward A. Mueller ............ 100,000 5.70 41.50 7/14/2015 2,609,913 6,614,031

Laura J. Alber ................ 60,000 3.42 38.84 5/27/2015 1,465,576 3,714,057

Sharon L. McCollam ........... 50,000 2.85 38.84 5/27/2015 1,221,313 3,095,048

Patrick J. Connolly ............ 40,000 2.28 38.84 5/27/2015 977,051 2,476,038

(1) In fiscal 2005, we granted options to purchase 1,754,990 shares of our common stock to our employees.

(2) Stock options generally vest in equal annual installments over a five-year period.

(3) The 5% and 10% assumed rates of appreciation are required by the SEC and do not represent our estimate or

projection of our future stock price.

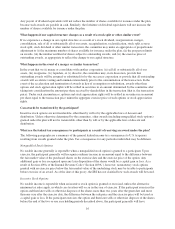

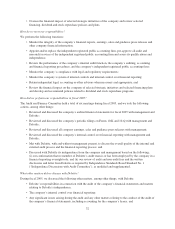

Aggregate Option Exercises in the Last Fiscal Year and Fiscal Year-End Option Values

This table sets forth information with respect to the named executive officers’ exercise of stock options during

fiscal 2005 and the fiscal year-end value of unexercised options held at the end of fiscal 2005.

Shares

Acquired on

Exercise

Value

Realized

Number of Securities

Underlying Unexercised

Options at Fiscal Year-End

Value of Unexercised

In-the-Money Options at Fiscal

Year-End(1)

Name Exercisable Unexercisable Exercisable Unexercisable

W. Howard Lester ......... 80,000 $2,642,400 1,482,500 42,500 $45,801,535 $ 643,750

Edward A. Mueller ......... — — 710,000 580,000 10,636,995 6,506,400

Laura J. Alber ............. 60,000 1,637,400 313,600 198,000 8,315,594 2,916,360

Sharon L. McCollam ....... 36,000 1,088,280 206,000 147,000 5,663,780 1,539,780

Patrick J. Connolly ......... — — 810,000 100,000 22,794,756 841,920

(1) The fiscal year-end values are based upon the difference between the closing price of our common stock on

the NYSE on January 27, 2006 ($40.62 per share) and the exercise price of the options.

22