Pottery Barn 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, we are involved in lawsuits, claims and proceedings incident to the ordinary course of our business.

These disputes, which are not currently material, are increasing in number as our business expands and our

company grows larger. Litigation is inherently unpredictable. Any claims against us, whether meritorious or not,

could be time consuming, result in costly litigation, require significant amounts of management time and result in

the diversion of significant operational resources. The results of these lawsuits, claims and proceedings cannot be

predicted with certainty. However, we believe that the ultimate resolution of these current matters will not have a

material adverse effect on our consolidated financial statements taken as a whole.

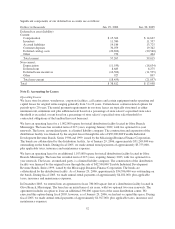

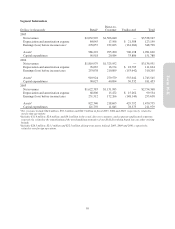

Note M: Segment Reporting

We have two reportable segments, retail and direct-to-customer. The retail segment has six merchandising

concepts which sell products for the home (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Hold Everything,

West Elm and Williams-Sonoma Home). The six retail merchandising concepts are operating segments, which

have been aggregated into one reportable segment, retail. The direct-to-customer segment has seven

merchandising concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, PBteen, Hold Everything, West

Elm and Williams-Sonoma Home) and sells similar products through our eight direct-mail catalogs (Williams-

Sonoma, Pottery Barn, Pottery Barn Kids, Pottery Barn Bed + Bath, PBteen, Hold Everything, West Elm and

Williams-Sonoma Home) and six e-commerce websites (williams-sonoma.com, potterybarn.com,

potterybarnkids.com, pbteen.com, westelm.com and holdeverything.com). Management’s expectation is that the

overall economics of each of our major concepts within each reportable segment will be similar over time.

These reportable segments are strategic business units that offer similar home-centered products. They are

managed separately because the business units utilize two distinct distribution and marketing strategies. It is not

practicable for us to report revenue by product group.

We use earnings before unallocated corporate overhead, interest and taxes to evaluate segment profitability.

Unallocated costs before income taxes include corporate employee-related costs, depreciation expense, other

occupancy expense and administrative costs, primarily in our corporate systems, corporate facilities and other

administrative departments. Unallocated assets include corporate cash and cash equivalents, the net book value of

corporate facilities and related information systems, deferred income taxes and other corporate long-lived assets.

Income tax information by segment has not been included as taxes are calculated at a company-wide level and

are not allocated to each segment.

58