Pottery Barn 2005 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

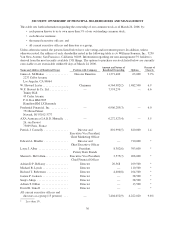

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 24, 2006 by the named

individual or entity into shares of our common stock. Based on 114,893,520 shares outstanding as of March 24, 2006.

(2) Mr. Lester owns $1,473,783 in the Williams-Sonoma, Inc. Stock Fund under our Associate Stock Incentive Plan, a

401(k) plan, as of March 24, 2006. The number of shares listed above includes 34,924 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc.

Stock Fund by $42.20, the closing price of Williams-Sonoma, Inc. common stock on March 24, 2006.

(3) The information above and in this footnote is based on information taken from the Schedule 13G of Prudential Financial,

Inc., filed with the SEC on February 10, 2006. Prudential Financial, Inc. has sole voting and sole dispositive power over

361,013 shares of our common stock. Prudential Financial, Inc. is a Parent Holding Company as defined in the Securities

and Exchange Act of 1934, as amended, and has shared voting power over 4,584,297 shares of our common stock and

shared dispositive power over 6,545,272 shares of our common stock with multiple entities to which it is a direct or

indirect parent (including Jennison Associates LLC, which separately filed a Schedule 13G with the Securities and

Exchange Commission on February 14, 2006, reporting sole voting power over 4,914,433 shares and shared dispositive

power with Prudential Financial, Inc. over 6,831,308 shares). Prudential Financial, Inc. may be deemed the beneficial

owner with direct or indirect voting and/or investment discretion over an aggregate of 6,906,285 shares of our common

stock which are held for its own benefit or for the benefit of its clients by its separate accounts, externally managed

accounts, registered investment companies, subsidiaries and/or other affiliates.

(4) The information above and in this footnote is based on information taken from the Schedule 13G of AXA Assurances

I.A.R.D. Mutuelle, filed with the SEC on February 14, 2006. AXA Assurances I.A.R.D. Mutuelle has shared voting

power over 6,349 shares of our common stock with its related entities, shared dispositive power over 5,239 shares of our

common stock with its related entities, sole voting power over 4,926,935 shares of our common stock and sole

dispositive power over 6,263,088 shares of our common stock.

(5) Mr. Connolly owns $1,114,884 in the Williams-Sonoma, Inc. Stock Fund under our Associate Stock Incentive Plan, a

401(k) plan, as of March 24, 2006. The number of shares listed above includes 26,419 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc.

Stock Fund by $42.20, the closing price of Williams-Sonoma, Inc. common stock on March 24, 2006.

(6) Ms. Alber owns $265,933 in the Williams-Sonoma, Inc. Stock Fund under our Associate Stock Incentive Plan, a 401(k)

plan, as of March 24, 2006. The number of shares listed above includes 6,302 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock Fund by

$42.20, the closing price of Williams-Sonoma, Inc. common stock on March 24, 2006.

(7) Ms. McCollam owns $133,995 in the Williams-Sonoma, Inc. Stock Fund under our Associate Stock Incentive Plan, a

401(k) plan, as of March 24, 2006. The number of shares listed above includes 3,175 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc.

Stock Fund by $42.20, the closing price of Williams-Sonoma, Inc. common stock on March 24, 2006.

(8) Includes 4,400 shares owned by Mr. Robertson’s wife.

(9) The directors and officers as a group own $3,023,680 in the Williams-Sonoma, Inc. Stock Fund under our Associate

Stock Incentive Plan, a 401(k) plan, as of March 24, 2006. The number of shares listed above includes 71,651 shares

held in the Williams-Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the

Williams-Sonoma, Inc. Stock Fund by $42.20, the closing price of Williams-Sonoma, Inc. common stock on March 24,

2006. Of the 71,651 shares, 159 are unvested and will fully vest by June 4, 2008.

37

Proxy