Pottery Barn 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

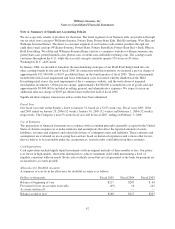

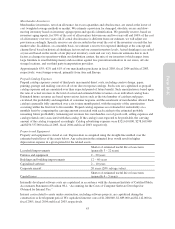

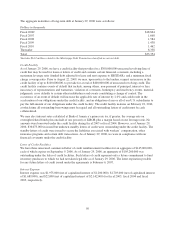

Note C: Borrowing Arrangements

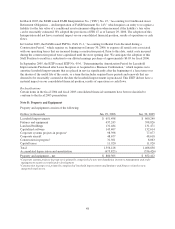

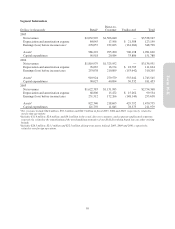

Long-term debt consists of the following:

Dollars in thousands Jan. 29, 2006 Jan. 30, 2005

Senior notes — $ 5,716

Obligations under capital leases $ 3,458 5,673

Memphis-based distribution facilities obligation 15,696 17,000

Industrial development bonds 14,200 14,200

Total debt 33,354 42,589

Less current maturities 18,864 23,435

Total long-term debt $14,490 $19,154

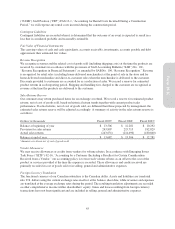

Senior Notes

In August, 2005, we repaid the remaining outstanding balance of $5,716,000 on our unsecured senior notes, with

interest payable semi-annually at 7.2% per annum.

Capital Leases

Our $3,458,000 of capital lease obligations consist primarily of in-store computer equipment leases with a term

of 60 months. The in-store computer equipment leases include an early purchase option at 54 months for

$2,496,000, which is approximately 25% of the acquisition cost. We have an end of lease purchase option to

acquire the equipment at the greater of fair market value or 15% of the acquisition cost.

Subsequent to year-end, we exercised the early purchase option on three of these leases and expect to exercise

this option on the remaining computer equipment leases during fiscal 2006.

See Note F for a discussion on our bond-related debt pertaining to our Memphis-based distribution facilities.

Industrial Development Bonds

In June 2004, in an effort to utilize tax incentives offered to us by the state of Mississippi, we entered into an

agreement whereby the Mississippi Business Finance Corporation issued $15,000,000 in long-term variable rate

industrial development bonds, the proceeds, net of debt issuance costs, of which were loaned to us to finance the

acquisition and installation of leasehold improvements and equipment located in our newly leased Olive Branch

distribution center (the “Mississippi Debt Transaction”). The bonds are marketed through a remarketing agent

and are secured by a letter of credit issued under our $300,000,000 line of credit facility. The bonds mature on

June 1, 2024. The bond rate resets each week based upon current market rates. The rate in effect at January 29,

2006 was 4.5%.

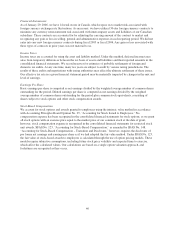

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of January 29, 2006, $14,200,000 remained

outstanding on these bonds and was classified as current debt. The bond proceeds are restricted for use in the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch, Mississippi

facility. As of January 29, 2006, we had acquired and installed $14,700,000 of leasehold improvements and

equipment associated with the facility.

49

Form 10-K