Pottery Barn 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

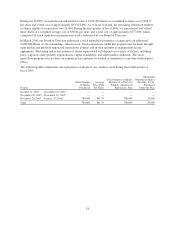

During fiscal 2005, we repurchased and retired a total of 2,422,300 shares at a weighted average cost of $38.77

per share and a total cost of approximately $93,921,000. As of fiscal year-end, the remaining authorized number

of shares eligible for repurchase was 20,000. During the first quarter of fiscal 2006, we repurchased and retired

these shares at a weighted average cost of $38.84 per share and a total cost of approximately $777,000, which

completed all stock repurchase programs previously authorized by our Board of Directors.

In March 2006, our Board of Directors authorized a stock repurchase program to acquire up to an additional

2,000,000 shares of our outstanding common stock. Stock repurchases under this program may be made through

open market and privately negotiated transactions at times and in such amounts as management deems

appropriate. The timing and actual number of shares repurchased will depend on a variety of factors, including

price, corporate and regulatory requirements, capital availability, and other market conditions. The stock

repurchase program does not have an expiration date and may be limited or terminated at any time without prior

notice.

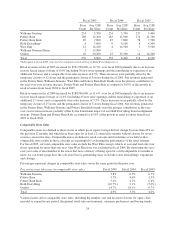

The following table summarizes our repurchases of shares of our common stock during the fourth quarter of

fiscal 2005:

Period

Total Number

of Shares

Purchased

Average

Price Paid

Per Share

Total Number of Shares

Purchased as Part of a

Publicly Announced

Repurchase Plan

Maximum

Number of Shares

that May Yet be

Purchased

Under the Plan

October 31, 2005 - November 27, 2005 — — — —

November 28, 2005 - December 25, 2005 — — — —

December 26, 2005 - January 29, 2006 780,800 $41.70 780,800 20,000

Total 780,800 $41.70 780,800 20,000

18