Pottery Barn 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result, we expect that throughout the year there could be ongoing variability in our quarterly tax rates as

taxable events occur and exposures are re-evaluated. Further, our effective tax rate in a given financial statement

period may be materially impacted by changes in the mix and level of earnings.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

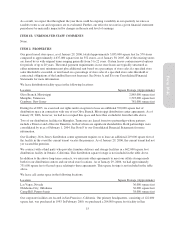

ITEM 2. PROPERTIES

Our gross leased store space, as of January 29, 2006, totaled approximately 5,035,000 square feet for 570 stores

compared to approximately 4,637,000 square feet for 552 stores, as of January 30, 2005. All of the existing stores

are leased by us with original terms ranging generally from 5 to 22 years. Certain leases contain renewal options

for periods of up to 20 years. The rental payment requirements in our store leases are typically structured as

either minimum rent, minimum rent plus additional rent based on a percentage of store sales if a specified store

sales threshold is exceeded, or rent based on a percentage of store sales if a specified store sales threshold or

contractual obligations of the landlord have not been met. See Notes A and E to our Consolidated Financial

Statements for more information.

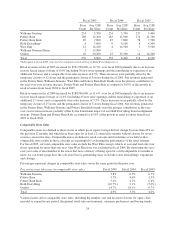

We lease distribution facility space in the following locations:

Location Square Footage (Approximate)

Olive Branch, Mississippi 2,885,000 square feet

Memphis, Tennessee 1,523,000 square feet

Cranbury, New Jersey 781,000 square feet

During fiscal 2005, we exercised our rights under an option to lease an additional 390,000 square feet of

distribution space in connection with one of our Olive Branch, Mississippi distribution center agreements. As of

January 29, 2006, however, we had not occupied this space and have thus excluded it from the table above.

Two of our distribution facilities in Memphis, Tennessee are leased from two partnerships whose partners

include a Director and a Director Emeritus, both of whom are significant shareholders. Both partnerships were

consolidated by us as of February 1, 2004. See Note F to our Consolidated Financial Statements for more

information.

Our Cranbury, New Jersey distribution center agreement requires us to lease an additional 219,000 square feet of

the facility in the event the current tenant vacates the premises. As of January 29, 2006, the current tenant had not

yet vacated the premises.

We contract with a third party who provides furniture delivery and storage facilities in a 662,000 square foot

distribution facility in Ontario, California. This distribution square footage is not included in the table above.

In addition to the above long-term contracts, we enter into other agreements to meet our offsite storage needs

both for our distribution centers and our retail store locations. As of January 29, 2006, we had approximately

731,000 square feet of leased space relating to these agreements. This square footage is not included in the table

above.

We lease call center space in the following locations:

Location Square Footage (Approximate)

Las Vegas, Nevada 36,000 square feet

Oklahoma City, Oklahoma 36,000 square feet

Camp Hill, Pennsylvania 38,000 square feet

Our corporate facilities are located in San Francisco, California. Our primary headquarters, consisting of 122,000

square feet, was purchased in 1993. In February 2000, we purchased a 204,000 square foot facility in San

15

Form 10-K