Pottery Barn 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET INFORMATION

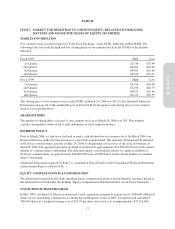

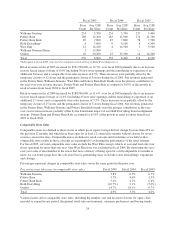

Our common stock is traded on the New York Stock Exchange, or the NYSE, under the symbol WSM. The

following table sets forth the high and low closing prices of our common stock on the NYSE for the periods

indicated.

Fiscal 2005 High Low

1st Quarter $37.40 $33.49

2nd Quarter $44.82 $34.08

3rd Quarter $44.05 $36.46

4th Quarter $45.09 $39.11

Fiscal 2004 High Low

1st Quarter $34.56 $30.68

2nd Quarter $32.96 $28.79

3rd Quarter $38.33 $29.46

4th Quarter $41.21 $33.55

The closing price of our common stock on the NYSE on March 24, 2006 was $42.20. See Quarterly Financial

Information on page 62 of this Annual Report on Form 10-K for the quarter-end closing price of our common

stock for each quarter above.

SHAREHOLDERS

The number of shareholders of record of our common stock as of March 24, 2006 was 503. This number

excludes shareholders whose stock is held in nominee or street name by brokers.

DIVIDEND POLICY

Prior to March 2006, we had never declared or paid a cash dividend on our common stock. In March 2006, our

Board of Directors authorized the initiation of a quarterly cash dividend. The quarterly dividend will be initiated

at $0.10 per common share, payable on May 24, 2006, to shareholders of record as of the close of business on

April 26, 2006. The aggregate quarterly dividend is estimated at approximately $11,500,000 based on the current

number of common shares outstanding. The indicated annual cash dividend, subject to capital availability, is

$0.40 per common share, or approximately $46,000,000 in fiscal 2006 based on the current number of common

shares outstanding.

Additional information required by Item 5 is contained in Notes H and I to the Consolidated Financial Statements

in this Annual Report on Form 10-K.

EQUITY COMPENSATION PLAN INFORMATION

The information required by this Item regarding equity compensation plans is incorporated by reference herein to

the information set forth under the heading “Equity Compensation Plan Information” in our Proxy Statement.

STOCK REPURCHASE PROGRAM

In May 2005, our Board of Directors authorized a stock repurchase program to acquire up to 2,000,000 additional

shares of our outstanding common stock. During the fourth quarter of fiscal 2005, we repurchased and retired

780,800 shares at a weighted average cost of $41.70 per share and a total cost of approximately $32,556,000.

17

Form 10-K