Pottery Barn 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

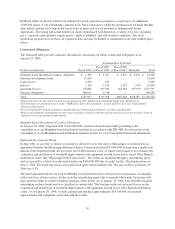

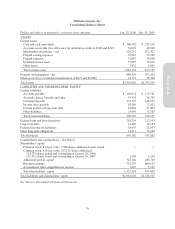

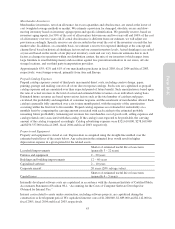

Williams-Sonoma, Inc.

Consolidated Balance Sheets

Dollars and shares in thousands, except per share amounts Jan. 29, 2006 Jan. 30, 2005

ASSETS

Current assets

Cash and cash equivalents $ 360,982 $ 239,210

Accounts receivable (less allowance for doubtful accounts of $168 and $217) 51,020 42,520

Merchandise inventories – net 520,292 452,421

Prepaid catalog expenses 53,925 53,520

Prepaid expenses 31,847 38,018

Deferred income taxes 57,267 39,015

Other assets 7,831 9,061

Total current assets 1,083,164 873,765

Property and equipment – net 880,305 852,412

Other assets (less accumulated amortization of $679 and $2,066) 18,151 19,368

Total assets $1,981,620 $1,745,545

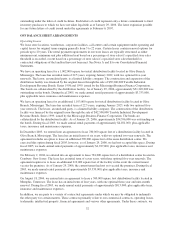

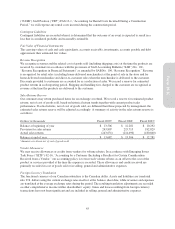

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Accounts payable $ 196,074 $ 173,781

Accrued salaries, benefits and other 93,434 86,767

Customer deposits 172,775 148,535

Income taxes payable 83,589 72,052

Current portion of long-term debt 18,864 23,435

Other liabilities 25,656 17,587

Total current liabilities 590,392 522,157

Deferred rent and lease incentives 218,254 212,193

Long-term debt 14,490 19,154

Deferred income tax liabilities 18,455 21,057

Other long-term obligations 14,711 13,322

Total liabilities 856,302 787,883

Commitments and contingencies – See Note L

Shareholders’ equity

Preferred stock, $.01 par value, 7,500 shares authorized, none issued — —

Common stock, $.01 par value, 253,125 shares authorized,

114,779 shares issued and outstanding at January 29, 2006;

115,372 shares issued and outstanding at January 30, 2005 1,148 1,154

Additional paid-in capital 325,146 286,720

Retained earnings 791,329 664,619

Accumulated other comprehensive income 7,695 5,169

Total shareholders’ equity 1,125,318 957,662

Total liabilities and shareholders’ equity $1,981,620 $1,745,545

See Notes to Consolidated Financial Statements.

39

Form 10-K