Pottery Barn 2005 Annual Report Download - page 48

Download and view the complete annual report

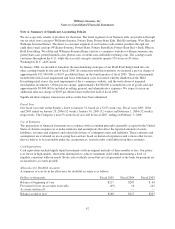

Please find page 48 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compensation expense has been recognized in the consolidated financial statements for stock options, as we grant

all stock options with an exercise price equal to the market price of our common stock at the date of grant,

however, stock compensation expense is recognized in the consolidated financial statements for restricted stock

unit awards. SFAS No. 123, “Accounting for Stock-Based Compensation,” as amended by SFAS No. 148,

“Accounting for Stock-Based Compensation – Transition and Disclosure,” however, requires the disclosure of

pro forma net earnings and earnings per share as if we had adopted the fair value method. Under SFAS No. 123,

the fair value of stock-based awards to employees is calculated through the use of option pricing models. These

models require subjective assumptions, including future stock price volatility and expected time to exercise,

which affect the calculated values. Our calculations are based on a single option valuation approach, and

forfeitures are recognized as they occur.

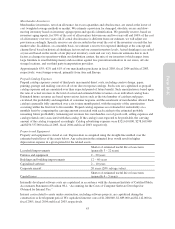

NEW ACCOUNTING PRONOUNCEMENTS

In December 2004, the FASB issued SFAS No. 123R, “Share Based Payment.” SFAS No. 123R will require us

to measure and record compensation expense in our consolidated financial statements for all employee share-

based compensation awards using a fair value method. In addition, the adoption of SFAS No. 123R requires

additional accounting and disclosure related to the income tax and cash flow effects resulting from share-based

payment arrangements. We expect to adopt this Statement using the modified prospective application transition

method beginning in the first quarter of fiscal 2006. We anticipate the adoption of this Statement to result in a

reduction to our diluted earnings per share of approximately $0.19 for fiscal 2006.

In March 2005, the FASB issued FIN No. 47, “Accounting for Conditional Asset Retirement Obligations – An

Interpretation of FASB Statement No. 143,” which requires an entity to recognize a liability for the fair value of

a conditional asset retirement obligation when incurred if the liability’s fair value can be reasonably estimated.

We adopted the provisions of FIN 47 as of January 29, 2006. The adoption of this Interpretation did not have a

material impact on our consolidated financial position, results of operations or cash flows.

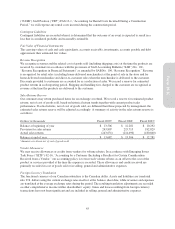

In October 2005, the FASB issued FASB Staff Position (“FSP”) No. FAS 13-1, “Accounting for Rental Costs

Incurred during a Construction Period,” which requires us, beginning on January 30, 2006, to expense all rental

costs associated with our operating leases that are incurred during a construction period. Prior to this date, rental

costs incurred during the construction period were capitalized until the store opening date. We anticipate the

adoption of this Staff Position to result in a reduction to our diluted earnings per share of approximately $0.03 for

fiscal 2006.

In September 2005, the Emerging Issues Task Force (“EITF”) issued EITF No. 05-6, “Determining the

Amortization Period for Leasehold Improvements Purchased after Lease Inception or Acquired in a Business

Combination,” which requires us to amortize leasehold improvements that are placed in service significantly

after the beginning of a lease term over the shorter of the useful life of the assets, or a term that includes required

lease periods and renewals that are deemed to be reasonably assumed at the date the leasehold improvement is

purchased. This EITF did not have a material impact on our consolidated financial position, results of operations

or cash flows.

36