Pottery Barn 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (“Communication

with Audit Committees”), as modified and supplemented, including the quality of the company’s

accounting principles, the soundness of significant judgments and the clarity of disclosures in the

company’s financial statements.

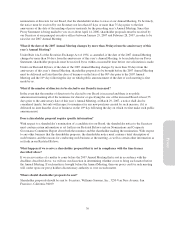

What is our policy regarding pre-approval of audit and non-audit services performed by Deloitte?

All services performed by Deloitte, whether audit or non-audit services, must be pre-approved by us or a

designated member of our committee, whose decisions must be reported to us at our next meeting. Pre-approval

must be obtained before Deloitte performs the services but cannot be obtained more than one year before

performance begins. Approval can be for general classes of permitted services such as annual audit services or

tax consulting services. A written engagement letter, including a description of the permitted services, the dates

of the engagement and the estimated fees for such services, must be approved by the Audit and Finance

Committee in accordance with these procedures before performance begins.

Did we review the fees billed by Deloitte for fiscal 2005?

Yes. We reviewed and discussed the fees billed by Deloitte for services in fiscal 2005, which are described in

detail below. We determined that the provision of non-audit services was compatible with Deloitte’s

independence.

Did we review the company’s audited financial statements for fiscal 2005?

Yes. We reviewed and discussed the company’s audited financial statements for fiscal 2005, and we

recommended to the Board that the company’s audited financial statements be included in the company’s Annual

Report on Form 10-K for fiscal 2005 for filing with the SEC.

Who prepared this report?

Members of the Audit and Finance Committee, Michael R. Lynch, Adrian T. Dillon and Jeanne P. Jackson,

prepared this report.

AUDIT AND RELATED FEES

During fiscal 2005 and 2004, Deloitte did not perform any prohibited non-audit services for us.

Audit Fees

Deloitte billed approximately $1,107,000 for fiscal 2005 and $1,141,000 for fiscal 2004 for professional services

to audit our consolidated financial statements included in our Annual Report on Form 10-K and to review our

condensed, consolidated financial statements included in our quarterly reports on Form 10-Q. Fees for audit

services billed also consisted of fees for the attestation of management’s assessment of internal control as

required by Section 404 of the Sarbanes-Oxley Act of 2002.

Audit-Related Fees

Deloitte billed approximately $22,800 for fiscal 2005 and $97,110 for fiscal 2004 for audit-related services.

Audit-related services included: (i) the audit of our 401(k) plan; (ii) consultation on various accounting matters;

(iii) consultation on our internal control; and (iv) assistance with our readiness under Section 404 of the

Sarbanes-Oxley Act of 2002.

Tax Fees

Deloitte billed a total of $141,225 for fiscal 2005 and $418,369 for fiscal 2004 for tax services. Tax services

included: (i) $24,000 for fiscal 2005 and $20,385 for fiscal 2004 for tax compliance services, which included

33

Proxy