Pottery Barn 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

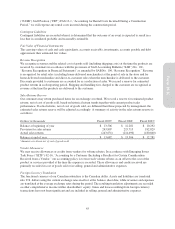

(“FASB”) Staff Position (“FSP”) FAS 13-1, “Accounting for Rental Costs Incurred During a Construction

Period,” we will expense any rental costs incurred during the construction period.

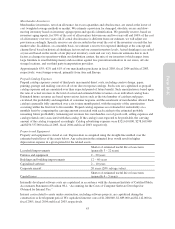

Contingent Liabilities

Contingent liabilities are recorded when it is determined that the outcome of an event is expected to result in a

loss that is considered probable and reasonably estimable.

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents, accounts receivable, investments, accounts payable and debt

approximate their estimated fair values.

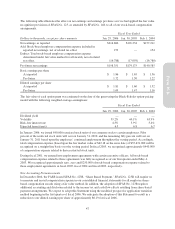

Revenue Recognition

We recognize revenues and the related cost of goods sold (including shipping costs) at the time the products are

received by customers in accordance with the provisions of Staff Accounting Bulletin (“SAB”) No. 101,

“Revenue Recognition in Financial Statements” as amended by SAB No. 104, “Revenue Recognition.” Revenue

is recognized for retail sales (excluding home-delivered merchandise) at the point of sale in the store and for

home-delivered merchandise and direct-to-customer sales when the merchandise is delivered to the customer.

Discounts provided to customers are accounted for as a reduction of sales. We record a reserve for estimated

product returns in each reporting period. Shipping and handling fees charged to the customer are recognized as

revenue at the time the products are delivered to the customer.

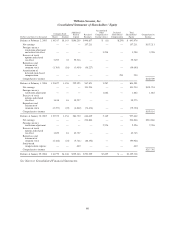

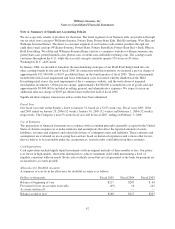

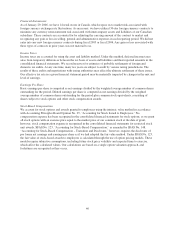

Sales Returns Reserve

Our customers may return purchased items for an exchange or refund. We record a reserve for estimated product

returns, net of cost of goods sold, based on historical return trends together with current product sales

performance. If actual returns, net of cost of goods sold, are different than those projected by management, the

estimated sales returns reserve will be adjusted accordingly. A summary of activity in the sales returns reserve is

as follows:

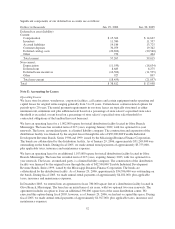

Dollars in thousands Fiscal 20051Fiscal 20041Fiscal 20031

Balance at beginning of year $ 13,506 $ 12,281 $ 10,292

Provision for sales returns 243,807 215,715 182,829

Actual sales returns (243,631) (214,490) (180,840)

Balance at end of year $ 13,682 $ 13,506 $ 12,281

1Amounts are shown net of cost of goods sold.

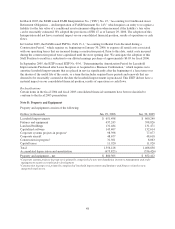

Vendor Allowances

We may receive allowances or credits from vendors for volume rebates. In accordance with Emerging Issues

Task Force (“EITF”) 02-16, “Accounting by a Customer (Including a Reseller) for Certain Consideration

Received from a Vendor,” our accounting policy is to treat such volume rebates as an offset to the cost of the

product or services provided at the time the expense is recorded. These allowances and credits received are

primarily recorded in cost of goods sold or in selling, general and administrative expenses.

Foreign Currency Translation

The functional currency of our Canadian subsidiary is the Canadian dollar. Assets and liabilities are translated

into U.S. dollars using the current exchange rates in effect at the balance sheet date, while revenues and expenses

are translated at the average exchange rates during the period. The resulting translation adjustments are recorded

as other comprehensive income within shareholders’ equity. Gains and losses resulting from foreign currency

transactions have not been significant and are included in selling, general and administrative expenses.

45

Form 10-K