Pottery Barn 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

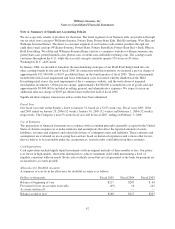

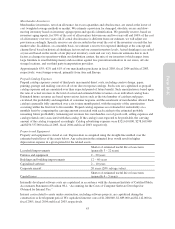

may provide certain routine indemnifications relating to representations and warranties or personal injury

matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically, we

have not made significant payments for these indemnifications. We believe that if we were to incur a loss in any

of these matters, the loss would not have a material effect on our financial condition or results of operations.

CONSOLIDATION OF MEMPHIS-BASED DISTRIBUTION FACILITIES

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of W. Howard

Lester, Chairman of the Board of Directors and a significant shareholder, and James A. McMahan, a Director

Emeritus and a significant shareholder. Partnership 1 does not have operations separate from the leasing of this

distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. Annual principal payments and monthly interest payments are

required through maturity in December 2010. The Partnership 1 industrial development bonds are collateralized

by the distribution facility and the individual partners guarantee the bond repayments. As of January 29, 2006,

$1,887,000 was outstanding under the Partnership 1 industrial development bonds.

During fiscal 2005, we made annual rental payments of approximately $618,000 plus interest on the bonds

calculated at a variable rate determined monthly (3.5% in January 2006), applicable taxes, insurance and

maintenance expenses. Although the current term of the lease expires in August 2006, we are obligated to renew

the operating lease on an annual basis until these bonds are fully repaid.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of W. Howard Lester, James A. McMahan and two unrelated

parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and does not

have lease agreements with any unrelated third parties.

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

collateralized by the distribution facility and require us to maintain certain financial covenants. As of January 29,

2006, $13,809,000 was outstanding under the Partnership 2 industrial development bonds.

During fiscal 2005, we made annual rental payments of approximately $2,600,000, plus applicable taxes,

insurance and maintenance expenses. This operating lease has an original term of 15 years expiring in August

2006, with three optional five-year renewal periods. We are, however, obligated to renew the operating lease on

an annual basis until these bonds are fully repaid.

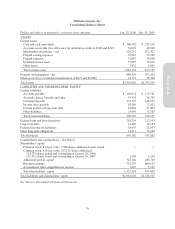

As of February 1, 2004, the Company adopted FIN 46R, which requires existing unconsolidated variable interest

entities to be consolidated by their primary beneficiaries if the entities do not effectively disperse risks among

parties involved. The two partnerships described above qualify as variable interest entities under FIN 46R due to

their related party relationship and our obligation to renew the leases until the bonds are fully repaid.

Accordingly, the two related party variable interest entity partnerships from which we lease our Memphis-based

distribution facilities were consolidated by us as of February 1, 2004. As of January 29, 2006, the consolidation

resulted in increases to our consolidated balance sheet of $18,250,000 in assets (primarily buildings),

$15,696,000 in debt, and $2,554,000 in other long-term liabilities. Consolidation of these partnerships did not

have an impact on our net income. However, the interest expense associated with the partnerships’ debt, shown

as occupancy expense in fiscal 2003, is now recorded as interest expense. In fiscal 2005 and fiscal 2004, this

interest expense approximated $1,462,000 and $1,525,000, respectively.

IMPACT OF INFLATION

The impact of inflation on our results of operations for the past three fiscal years has not been significant.

33

Form 10-K