Pottery Barn 2005 Annual Report Download - page 116

Download and view the complete annual report

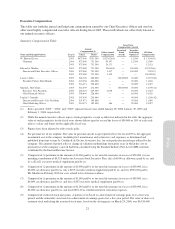

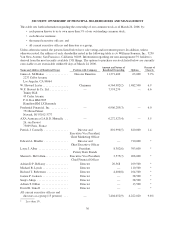

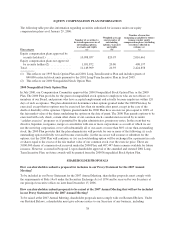

Please find page 116 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.under the company’s 2001 Incentive Bonus Plan because the Company Objective was exceeded. In determining

Mr. Mueller’s compensation, we also consider overall company performance. The company’s one-year return on

shareholder’s equity for fiscal 2005 was 20.6%. Mr. Mueller’s base salary fell within the third quartile of base

salaries paid to chief executive officers at comparable companies, and his bonus fell within the third quartile with

respect to the same group. Together, base salary and the bonus target place his annual cash compensation within

the third quartile of similarly situated executive officers at comparable companies. During fiscal 2005,

Mr. Mueller also received $300,000 for costs related to his Arizona residence. Mr. Mueller received no other

additional material compensation or benefits not provided to all executives.

Are there any other compensation considerations?

The company believes its benefit programs generally should be comparable for all employees. However, we

recommend additional benefits for certain individuals from time to time if we determine that the category and

amount of such benefits are reasonable and necessary to provide additional incentives to attract or retain key

executives.

Do our executive officers have change of control arrangements?

Our named executive officers who received restricted stock unit grants in fiscal 2005, as specified in the

Summary Compensation Table, will receive accelerated vesting of such awards in the event of a change of

control. Otherwise, our executive officers do not have arrangements that provide them with specific benefits

upon or following a change of control. None of our executive officers is guaranteed any type of golden parachute

excise tax gross-up. Our equity compensation plans do not provide for automatic vesting acceleration upon or

following a change of control. The Compensation Committee has considered the total potential cost of the change

of control protection afforded to our executive officers and has determined that it is reasonable and not excessive.

Do our executive officers have severance protection?

As noted in the “Employment Contracts and Termination of Employment and Change-of-Control Arrangements”

section, if Laura J. Alber, our President, Pottery Barn Brands, or Sharon L. McCollam, our Executive Vice

President, Chief Financial Officer, is terminated without cause or voluntarily terminates her employment for

good reason, she will be entitled to severance benefits. Also, our named executive officers who received

restricted stock unit grants in fiscal 2005 will have such awards vest in full upon a termination due to their death,

permanent disability, or retirement after attaining age 55 and working with us or our subsidiaries for at least 10

years. Otherwise, our executive officers do not have arrangements that provide them with specific benefits upon

their termination. The Compensation Committee has considered the total potential cost of the severance benefits

to our executive officers and determined them to be reasonable and not excessive.

Have we changed our equity compensation practices in light of the new equity compensation accounting rules?

Commencing with our 2006 fiscal year, we are required to account for our equity compensation awards under

Financial Accounting Standards No. 123R (“FAS 123R”). Under FAS 123R, we are required to record

compensation expense in connection with equity awards to our associates and members of the Board. We

actively consider the potential impact of the changes in the financial accounting treatment of equity

compensation arrangements on the company’s reported earnings.

Do we provide perquisites to our executive officers?

We provide certain perquisites to our executive officers, including premiums for term life insurance in excess of

$50,000, a matching contribution for investments in our Associate Stock Incentive Plan, a $500 monthly car

allowance and an annual executive medical supplement of up to $2,500. Some of these perquisites are also

provided to other employees. Details about perquisites provided to individual named executive officers are

included in the Executive Compensation table included in this Proxy Statement.

28