Pottery Barn 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

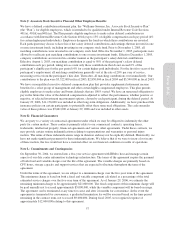

members of the company and any parent or subsidiary. Annual grants are limited to options to purchase

1,000,000 shares, 200,000 shares of restricted stock, and deferred stock awards of up to 200,000 shares on a per

person basis. All stock option grants made under the 2001 Plan have a maximum term of ten years, except

incentive stock options issued to 10% shareholders, which have a maximum term of five years. The exercise

price of these stock options is not less than 100% of the fair market value of our stock on the date of the option

grant or not less than 110% of such fair market value for an incentive stock option granted to a 10% shareholder.

Options granted to employees generally vest over five years. Options granted to non-employee Board members

generally vest in one year. Non-employee Board members automatically receive stock options on the date of

their initial election to the Board and annually thereafter on the date of the annual meeting of shareholders (so

long as they continue to serve as a non-employee Board member).

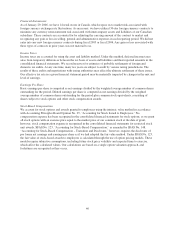

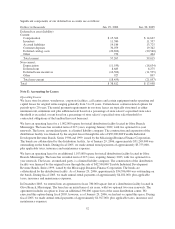

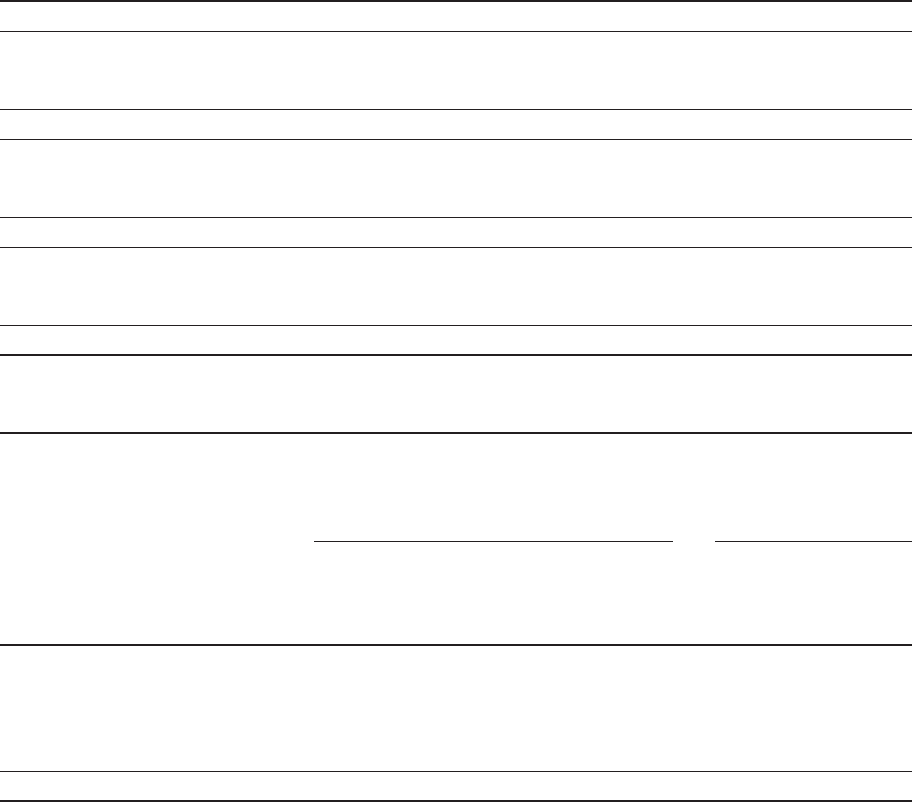

The following table reflects the aggregate activity under our stock option plans:

Shares

Weighted Average

Exercise Price

Balance at February 2, 2003 14,567,106 $14.77

Granted (weighted average fair value of $15.56) 1,596,075 24.37

Exercised (3,294,478) 11.87

Canceled (1,089,045) 18.07

Balance at February 1, 2004 11,779,658 16.58

Granted (weighted average fair value of $20.58) 1,626,811 32.57

Exercised (1,817,308) 14.41

Canceled (488,734) 20.81

Balance at January 30, 2005 11,100,427 19.08

Granted (weighted average fair value of $23.77) 1,754,990 39.07

Exercised (1,829,082) 15.30

Canceled (716,426) 26.81

Balance at January 29, 2006 10,309,909 22.63

Exercisable, February 1, 2004 5,077,371 $12.83

Exercisable, January 30, 2005 5,461,541 14.26

Exercisable, January 29, 2006 5,704,164 16.00

Options to purchase 2,424,858 shares were available for grant at January 29, 2006.

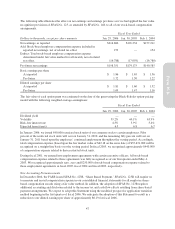

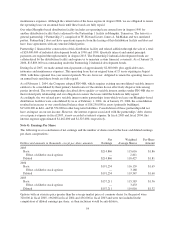

The following table summarizes information about stock options outstanding at January 29, 2006:

Options Outstanding Options Exercisable

Range of exercise prices

Number

Outstanding

Weighted

Average

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Number

Exercisable

Weighted

Average

Exercise

Price

$ 4.50 – $ 9.50 1,651,008 2.71 $ 8.17 1,651,008 $ 8.17

$ 9.66 – $14.50 1,880,843 4.07 12.80 1,529,680 12.61

$15.00 – $22.47 2,006,335 5.68 19.56 1,282,100 18.26

$22.48 – $31.58 1,786,723 7.14 26.80 922,126 26.66

$32.01 – $43.85 2,985,000 8.82 36.39 319,250 32.92

$ 4.50 – $43.85 10,309,909 6.07 $22.63 5,704,164 $16.00

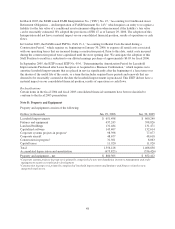

In January 2006, we issued 840,000 restricted stock units of our common stock to certain employees. Fifty

percent of the restricted stock units will vest on January 31, 2010, and the remaining fifty percent will vest on

January 31, 2011 based upon the employees’ continued employment throughout the vesting period. As of

January 29, 2006, 840,000 restricted stock units were outstanding.

56