Pottery Barn 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Instruments

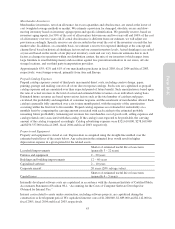

As of January 29, 2006, we have 14 retail stores in Canada, which expose us to market risk associated with

foreign currency exchange rate fluctuations. As necessary, we have utilized 30-day foreign currency contracts to

minimize any currency remeasurement risk associated with intercompany assets and liabilities of our Canadian

subsidiary. These contracts are accounted for by adjusting the carrying amount of the contract to market and

recognizing any gain or loss in selling, general and administrative expenses in each reporting period. We did not

enter into any new foreign currency contracts during fiscal 2005 or fiscal 2004. Any gain or loss associated with

these types of contracts in prior years was not material to us.

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

consolidated financial statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Our effective tax rate in a given financial statement period may be materially impacted by changes in the mix and

level of earnings.

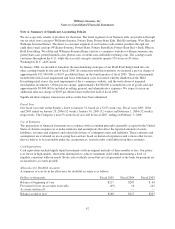

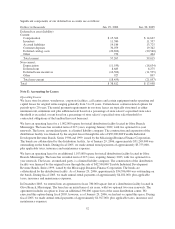

Earnings Per Share

Basic earnings per share is computed as net earnings divided by the weighted average number of common shares

outstanding for the period. Diluted earnings per share is computed as net earnings divided by the weighted

average number of common shares outstanding for the period plus common stock equivalents, consisting of

shares subject to stock options and other stock compensation awards.

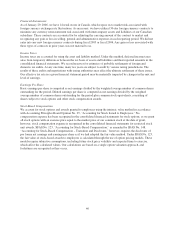

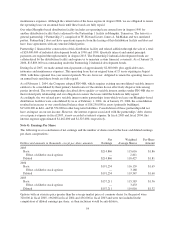

Stock-Based Compensation

We account for stock options and awards granted to employees using the intrinsic value method in accordance

with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees.” No

compensation expense has been recognized in the consolidated financial statements for stock options, as we grant

all stock options with an exercise price equal to the market price of our common stock at the date of grant,

however, stock compensation expense is recognized in the consolidated financial statements for restricted stock

unit awards. SFAS No. 123, “Accounting for Stock-Based Compensation,” as amended by SFAS No. 148,

“Accounting for Stock-Based Compensation – Transition and Disclosure,” however, requires the disclosure of

pro forma net earnings and earnings per share as if we had adopted the fair value method. Under SFAS No. 123,

the fair value of stock-based awards to employees is calculated through the use of option pricing models. These

models require subjective assumptions, including future stock price volatility and expected time to exercise,

which affect the calculated values. Our calculations are based on a single option valuation approach, and

forfeitures are recognized as they occur.

46