Pottery Barn 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note H: Common Stock

Authorized preferred stock consists of 7,500,000 shares at $0.01 par value of which none was outstanding during

fiscal 2005 or fiscal 2004. Authorized common stock consists of 253,125,000 shares at $0.01 par value. Common

stock outstanding at the end of fiscal 2005 and fiscal 2004 was 114,779,000 and 115,372,000 shares,

respectively. Our Board of Directors is authorized to issue stock options for up to the total number of shares

authorized and remaining available for grant under each plan.

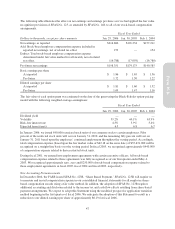

In May 2005, our Board of Directors authorized a stock repurchase program to acquire up to 2,000,000 additional

shares of our outstanding common stock. During the fourth quarter of fiscal 2005, we repurchased and retired

780,800 shares at a weighted average cost of $41.70 per share and a total cost of approximately $32,556,000.

During fiscal 2005, we repurchased and retired a total of 2,422,300 shares at a weighted average cost of $38.77

per share and a total cost of approximately $93,921,000. As of fiscal year-end, the remaining authorized number

of shares eligible for repurchase was 20,000. During the first quarter of fiscal 2006, we repurchased and retired

these shares at a weighted average cost of $38.84 per share and a total cost of approximately $777,000, which

completed all stock repurchase programs previously authorized by our Board of Directors.

In March 2006, our Board of Directors authorized a stock repurchase program to acquire up to an additional

2,000,000 shares of our outstanding common stock. Stock repurchases under this program may be made through

open market and privately negotiated transactions at times and in such amounts as management deems appropriate.

The timing and actual number of shares repurchased will depend on a variety of factors, including price, corporate

and regulatory requirements, capital availability, and other market conditions. The stock repurchase program does

not have an expiration date and may be limited or terminated at any time without prior notice.

Prior to March 2006, we had never declared or paid a cash dividend on our common stock. In March 2006, our

Board of Directors authorized the initiation of a quarterly cash dividend. The quarterly dividend will be initiated

at $0.10 per common share, payable on May 24, 2006, to shareholders of record as of the close of business on

April 26, 2006. The aggregate quarterly dividend is estimated at approximately $11,500,000 based on the current

number of common shares outstanding. The indicated annual cash dividend, subject to capital availability, is

$0.40 per common share, or approximately $46,000,000 in fiscal 2006 based on the current number of common

shares outstanding.

Note I: Stock Compensation

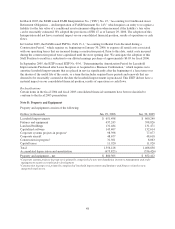

Our 1993 Stock Option Plan, as amended (the “1993 Plan”), provides for grants of incentive and nonqualified

stock options up to an aggregate of 17,000,000 shares. Stock options may be granted under the 1993 Plan to key

employees and Board members of the company and any parent or subsidiary. Annual grants are limited to

options to purchase 200,000 shares on a per person basis under this plan. All stock option grants made under the

1993 Plan have a maximum term of ten years, except incentive stock options issued to shareholders with greater

than 10% of the voting power of all of our stock, which have a maximum term of five years. The exercise price

of these options is not less than 100% of the fair market value of our stock on the date of the option grant or not

less than 110% of such fair market value for an incentive stock option granted to a 10% shareholder. Options

granted to employees generally vest over five years. Options granted to non-employee Board members generally

vest in one year.

Our 2000 Nonqualified Stock Option Plan, as amended (the “2000 Plan”), provides for grants of nonqualified

stock options up to an aggregate of 3,000,000 shares. Stock options may be granted under the 2000 Plan to

employees who are not officers or Board members. Annual grants are not limited on a per person basis under this

plan. All nonqualified stock option grants under the 2000 Plan have a maximum term of ten years with an

exercise price of 100% of the fair value of the stock at the option grant date. Options granted to employees

generally vest over five years.

Our Amended and Restated 2001 Long-Term Incentive Plan (the “2001 Plan”) provides for grants of incentive

stock options, nonqualified stock options, restricted stock awards and deferred stock awards up to an aggregate of

8,500,000 shares. Awards may be granted under the 2001 Plan to officers, employee and non-employee Board

55

Form 10-K