Pottery Barn 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Any payout of dividend equivalents will not reduce the number of shares available for issuance under the plan,

because such awards are payable in cash. Similarly, the forfeiture of dividend equivalents will not increase the

number of shares available for issuance under the plan.

What happens if our capital structure changes as a result of a stock split or other similar event?

If we experience a change in our capital structure as a result of a stock dividend, reorganization, merger,

consolidation, sale of all or substantially all of our assets, recapitalization, reclassification, stock split, reverse

stock split, stock dividend or other similar transaction, the committee may make an appropriate or proportionate

adjustment to (i) the maximum number of shares available for issuance under the plan, (ii) the per person limits

on awards, (iii) the number and kind of shares subject to outstanding awards, and (iv) the exercise price of

outstanding awards, as appropriate to reflect the change to our capital structure.

What happens in the event of a merger or similar transaction?

In the event that we (i) merge or consolidate with another corporation, (ii) sell all or substantially all of our

assets, (iii) reorganize, (iv) liquidate, or (v) dissolve, the committee may, in its discretion, provide that

outstanding awards will be assumed or substituted for by the successor corporation or provide that all outstanding

awards will accelerate vesting and terminate immediately prior to the consummation of the transaction. In the

event of the acceleration and termination of awards in lieu of assumption or substitution, awards other than

options and stock appreciation rights will be settled in securities in an amount determined by the committee after

taking into consideration the amount per share received by shareholders in the transaction (that is, the transaction

price). Under such circumstances, options and stock appreciation rights will be settled in securities in an amount

per share equal to the transaction price minus the aggregate exercise price of such options or stock appreciation

rights.

Can awards be transferred by the participant?

Incentive stock options are not transferable, other than by will or by the applicable laws of descent and

distribution. Unless otherwise determined by the committee, other awards (including nonqualified stock options)

granted under the plan will not be transferable, other than by will or by the applicable laws of descent and

distribution.

What are the federal tax consequences to participants as a result of receiving an award under the plan?

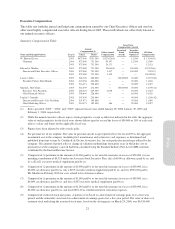

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers

resulting from awards granted under the plan. Tax consequences for any particular individual may be different.

Nonqualified Stock Options

No taxable income generally is reportable when a nonqualified stock option is granted to a participant. Upon

exercise, the participant generally will recognize ordinary income in an amount equal to the difference between

the fair market value of the purchased shares on the exercise date and the exercise price of the option. Any

additional gain or loss recognized upon any later disposition of the shares would be a capital gain or loss. As a

result of Section 409A of the Internal Revenue Code (“Section 409A”), however, nonstatutory stock options

granted with an exercise price below the fair market value of the underlying stock may be taxable to participants

before exercise of an award. As of the date of this proxy, the IRS has not clarified how such awards will be taxed.

Incentive Stock Options

No taxable income is reportable when an incentive stock option is granted or exercised, unless the alternative

minimum tax rules apply, in which case taxation will occur in the year of exercise. If the participant exercises the

option and then later sells or otherwise disposes of the shares more than two years after the grant date and more

than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as

a capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares

before the end of the two or one year holding periods described above, the participant generally will have

16