Pottery Barn 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Section 162(m) of the Internal Revenue Code, the annual compensation paid to any of these specified executives

will be deductible only to the extent that it does not exceed $1,000,000. However, we can preserve the

deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These

conditions include: (i) shareholder approval of the plan; (ii) setting limits on the number of awards that any

individual may receive; and (iii) establishing performance criteria that must be met before the award actually will

vest or be paid. The plan has been designed to permit the committee to grant awards that qualify as performance-

based for purposes of satisfying the conditions of Section 162(m), thereby permitting us to continue to receive a

federal income tax deduction in connection with such awards.

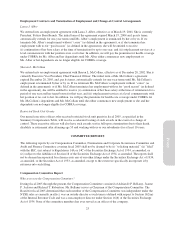

How can we amend or terminate the plan?

The Board generally may amend or terminate the plan at any time and for any reason. Amendments will be

contingent on shareholder approval if required by applicable law, stock exchange listing requirements or if so

promised by the Board. By its terms, the amended and restated plan will automatically terminate on March 15,

2016, which is 10 years from the date the Board approved the amended and restated plan.

Why do we recommend that the 2001 Long-Term Incentive Plan be amended and restated?

We believe that the amended and restated plan is essential to our continued success. Our employees are our most

valuable asset. Stock options and other awards such as those provided under the plan will substantially assist us

in continuing to attract and retain employees and non-employee directors in the extremely competitive labor

markets in which we compete. Such awards also are crucial to our ability to motivate employees to achieve our

goals. We will benefit from increased stock ownership by selected executives, other employees and

non-employee directors. The increase in the reserve of common stock available under the plan will enable us to

grant such awards to executives, other eligible employees and our non-employee directors.

What vote is required to approve this proposal?

To approve this proposal, a majority of the shares represented and voting at the Annual Meeting and a majority

of the quorum required to transact business at the Annual Meeting must vote “FOR” this proposal.

Brokers and other nominees that are NYSE member organizations are prohibited from voting in favor of

proposals relating to equity compensation plans, such as the amended and restated 2001 Long-Term Incentive

Plan, unless they receive specific instructions from the beneficial owner of the shares to vote on such matters.

Therefore, for any of your shares held through a broker or other nominee that is a NYSE member organization,

such shares will only be voted on this proposal if you have provided specific voting instructions to your broker or

other nominee on how to vote your shares. As a result, proxy cards marked “abstain” and broker non-votes are

not counted as votes cast.

If approved, when would the amended and restated plan become effective?

The amended and restated plan would become effective upon shareholder approval at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE 2001 LONG-TERM INCENTIVE

PLAN.

18