Pottery Barn 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

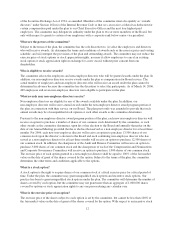

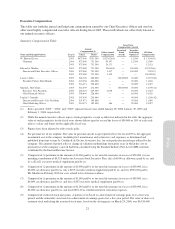

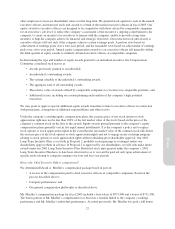

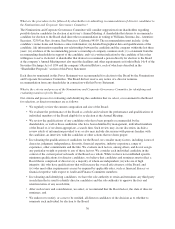

Executive Compensation

This table sets forth the annual and long-term compensation earned by our Chief Executive Officer and our four

other most highly compensated executive officers during fiscal 2005. These individuals are collectively known as

our named executive officers.

Summary Compensation Table

Name and Principal Position Year(1)

Annual

Compensation(2) Other Annual

Compensation

Long-Term

Compensation Awards

All Other

Compensation

Restricted

Stock

Awards

Securities

Underlying

Options(3)Salary Bonus

W. Howard Lester ....................... 2005 $975,000 $731,300 $327,624(4) — 12,500 $ 13,146(5)

Chairman 2004 975,000 731,300 99,397 — 12,500 12,990

2003 975,000 731,300 24,171 — — 12,621

Edward A. Mueller ...................... 2005 975,000 731,300 19,063(4) — 100,000 307,105(6)

Director and Chief Executive Officer 2004 975,000 731,300 3,437 — 100,000 7,245(7)

2003 975,000 731,300 4,193 — — 196,250(8)

Laura J. Alber .......................... 2005 588,749 280,000 — 150,000(9) 60,000 12,155(10)

President, Pottery Barn Brands 2004 474,356 246,000 — — 50,000 11,836

2003 514,471 258,800 — — 30,000 14,027

Sharon L. McCollam ..................... 2005 516,539 274,000 — 150,000(9) 50,000 13,739(11)

Executive Vice President, 2004 484,423 235,000 2,029 — 50,000 12,623

Chief Financial Officer 2003 398,846 228,600 — — 85,000 14,129

Patrick J. Connolly ...................... 2005 547,405 230,000 — — 40,000 11,530(12)

Director and Executive Vice President, 2004 531,971 190,000 — — 50,000 11,069

Chief Marketing Officer 2003 514,471 193,000 186 — 20,000 14,027

(1) Rows specified “2005,” “2004” and “2003” represent fiscal years ended January 29, 2006, January 30, 2005 and

February 1, 2004, respectively.

(2) While the named executive officers enjoy certain perquisites, except as otherwise indicated in the table, the aggregate

value of such perquisites for the fiscal years shown did not equal or exceed the lesser of $50,000 or 10% of each such

officer’s salary and bonus for the applicable fiscal year.

(3) Figures have been adjusted to reflect stock splits.

(4) For personal use of our airplane. The value of personal aircraft usage reported above for fiscal 2005 is the aggregate

incremental cost to the company (including fuel, maintenance and certain fees and expenses) as determined and

published from time to time by Conklin & de Decker Associates, Inc. for each particular aircraft type utilized by the

company. The amounts reported reflect a change in valuation methodology from prior years in which the cost of

personal use of the company’s aircraft had been calculated using the Standard Industry Fare Level (SIFL) formula

established by the Internal Revenue Service.

(5) Comprised of (i) premiums in the amount of $1,000 paid by us for term life insurance in excess of $50,000, (ii) our

matching contribution of $4,325 under our Associate Stock Incentive Plan, (iii) a $6,000 car allowance paid by us, and

(iv) a $1,821 executive medical supplement paid by us.

(6) Comprised of (i) premiums in the amount of $1,000 paid by us for term life insurance in excess of $50,000, (ii) a

$6,000 car allowance paid by us, (iii) a $105 executive medical supplement paid by us, and (iv) $300,000 paid to

Mr. Mueller in February 2005 for costs related to his Arizona residence.

(7) Comprised of (i) premiums in the amount of $1,140 paid by us for term life insurance in excess of $50,000, (ii) a

$6,000 car allowance paid by us, and (iii) a $105 executive medical supplement paid by us.

(8) Comprised of (i) premiums in the amount of $1,140 paid by us for term life insurance in excess of $50,000, (ii) a

$6,000 car allowance paid by us, and (iii) $189,110 as reimbursement for relocation expenses.

(9) Comprised of restricted stock unit grants. A portion vests based on achievement of earnings goals over a four-year

period, and the remainder vests based on achievement of earnings goals over a five-year period. The value of shares of

common stock underlying the restricted stock units, based on the closing price on March 24, 2006, was $6,330,000.

21

Proxy