Pottery Barn 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

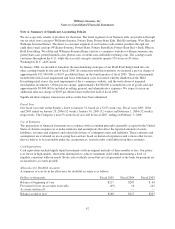

In March 2005, the FASB issued FASB Interpretation No. (“FIN”) No. 47, “Accounting for Conditional Asset

Retirement Obligations – An Interpretation of FASB Statement No. 143,” which requires an entity to recognize a

liability for the fair value of a conditional asset retirement obligation when incurred if the liability’s fair value

can be reasonably estimated. We adopted the provisions of FIN 47 as of January 29, 2006. The adoption of this

Interpretation did not have a material impact on our consolidated financial position, results of operations or cash

flows.

In October 2005, the FASB issued FSP No. FAS 13-1, “Accounting for Rental Costs Incurred during a

Construction Period,” which requires us, beginning on January 30, 2006, to expense all rental costs associated

with our operating leases that are incurred during a construction period. Prior to this date, rental costs incurred

during the construction period were capitalized until the store opening date. We anticipate the adoption of this

Staff Position to result in a reduction to our diluted earnings per share of approximately $0.03 for fiscal 2006.

In September 2005, the EITF issued EITF No. 05-6, “Determining the Amortization Period for Leasehold

Improvements Purchased after Lease Inception or Acquired in a Business Combination,” which requires us to

amortize leasehold improvements that are placed in service significantly after the beginning of a lease term over

the shorter of the useful life of the assets, or a term that includes required lease periods and renewals that are

deemed to be reasonably assumed at the date the leasehold improvement is purchased. This EITF did not have a

material impact on our consolidated financial position, results of operations or cash flows.

Reclassifications

Certain items in the fiscal 2004 and fiscal 2003 consolidated financial statements have been reclassified to

conform to the fiscal 2005 presentation.

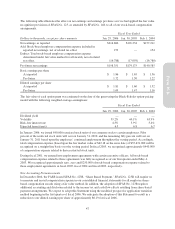

Note B: Property and Equipment

Property and equipment consists of the following:

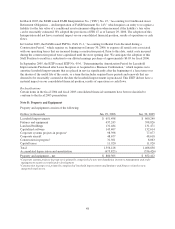

Dollars in thousands Jan. 29, 2006 Jan. 30, 2005

Leasehold improvements $ 651,498 $ 600,249

Fixtures and equipment 437,243 398,826

Land and buildings 131,484 131,471

Capitalized software 145,407 132,614

Corporate systems projects in progress198,398 77,077

Corporate aircraft 48,677 48,618

Construction in progress231,501 8,063

Capital leases 11,920 11,920

Total 1,556,128 1,408,838

Accumulated depreciation and amortization (675,823) (556,426)

Property and equipment – net $ 880,305 $ 852,412

1Corporate systems projects in progress is primarily comprised of a new merchandising, inventory management and order

management system currently under development.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

unopened retail stores.

48