Pottery Barn 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

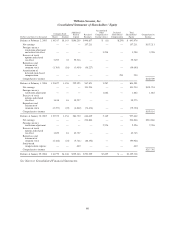

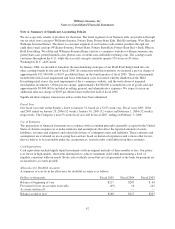

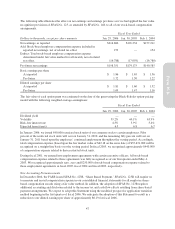

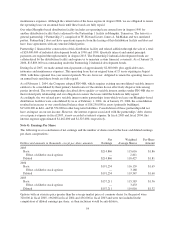

The following table illustrates the effect on net earnings and earnings per share as if we had applied the fair value

recognition provisions of SFAS No. 123, as amended by SFAS No. 148, to all of our stock-based compensation

arrangements.

Fiscal Year Ended

Dollars in thousands, except per share amounts Jan. 29, 2006 Jan. 30, 2005 Feb. 1, 2004

Net earnings, as reported $214,866 $191,234 $157,211

Add: Stock-based employee compensation expense included in

reported net earnings, net of related tax effect 273 — 154

Deduct: Total stock-based employee compensation expense

determined under fair value method for all awards, net of related

tax effect (16,788) (17,059) (16,780)

Pro forma net earnings $198,351 $174,175 $140,585

Basic earnings per share

As reported $ 1.86 $ 1.65 $ 1.36

Pro forma 1.72 1.50 1.22

Diluted earnings per share

As reported $ 1.81 $ 1.60 $ 1.32

Pro forma 1.69 1.47 1.16

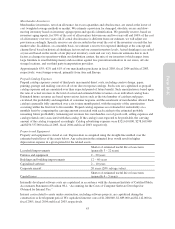

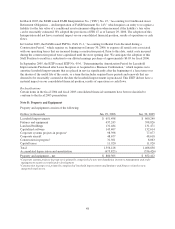

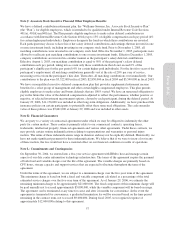

The fair value of each option grant was estimated on the date of the grant using the Black-Scholes option-pricing

model with the following weighted average assumptions:

Fiscal Year Ended

Jan. 29, 2006 Jan. 30, 2005 Feb. 1, 2004

Dividend yield — — —

Volatility 59.2% 60.1% 63.9%

Risk-free interest rate 4.3% 3.9% 3.4%

Expected term (years) 6.5 6.8 6.7

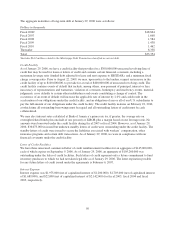

In January 2006, we issued 840,000 restricted stock units of our common stock to certain employees. Fifty

percent of the restricted stock units will vest on January 31, 2010, and the remaining fifty percent will vest on

January 31, 2011 based upon the employees’ continued employment throughout the vesting period. Accordingly,

total compensation expense (based upon the fair market value of $42.18 on the issue date) of $35,431,000 will be

recognized on a straight-line basis over the vesting period. In fiscal 2005, we recognized approximately $440,000

of compensation expense related to these restricted stock units.

During fiscal 2001, we entered into employment agreements with certain executive officers. All stock-based

compensation expense related to these agreements was fully recognized as of our first quarter ended May 4,

2003. We recognized approximately zero, zero and $250,000 of stock-based compensation expense related to

these employment agreements in fiscal 2005, fiscal 2004 and fiscal 2003, respectively.

New Accounting Pronouncements

In December 2004, the FASB issued SFAS No. 123R, “Share Based Payment.” SFAS No. 123R will require us

to measure and record compensation expense in our consolidated financial statements for all employee share-

based compensation awards using a fair value method. In addition, the adoption of SFAS No. 123R requires

additional accounting and disclosure related to the income tax and cash flow effects resulting from share-based

payment arrangements. We expect to adopt this Statement using the modified prospective application transition

method beginning in the first quarter of fiscal 2006. We anticipate the adoption of this Statement to result in a

reduction to our diluted earnings per share of approximately $0.19 for fiscal 2006.

47

Form 10-K