Pottery Barn 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

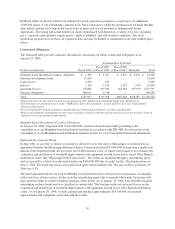

During fiscal 2005, we also made significant progress in building our infrastructure to support the growth of our

core and emerging brands. In the information technology area, we continued to make important progress on our

5-year strategic plan. We transitioned the majority of our data center operations to IBM while continuing to

evaluate the long-term strategy for our e-commerce websites. We also continued to invest in our

direct-to-customer order management and inventory management systems, which are currently in beta testing. In

fiscal 2006, we will begin implementing a new retail inventory management system. These multi-phase, multi-

year technology initiatives are at the heart of our long-term efforts to drive increased sales and reduce costs

through increased productivity and operational efficiency.

In the area of supply chain operations, we successfully implemented “Daily Store Replenishment” in the retail

channel and began testing an in-sourcing strategy for our furniture hub operations on the east coast. We also

added to our distribution network by increasing distribution leased square footage by approximately 10%.

On our “Weeks of Supply” inventory management initiative, we made gradual progress throughout the year in

optimizing the flow of our merchandise through the supply chain. We improved our order fulfillment rates and

reduced customer back-orders. The full benefit of this initiative, however, will not be realized until we have fully

implemented our new inventory management system.

Fiscal 2006

In fiscal 2006, in an effort to enhance shareholder value, we will continue to focus on our long-term strategic

initiatives of driving profitable top-line sales growth and increasing our pre-tax operating margin.

To drive profitable top-line sales growth, we expect to increase retail leased square footage, increase comparable

store sales, and increase catalog and page circulation.

In our core brands, we expect to add 11 new retail stores, reopen four stores associated with Hurricane Katrina,

open three new Pottery Barn Bed + Bath test stores and remodel or expand 18 existing stores. In the

direct-to-customer channel, we expect to increase catalog circulation and electronic direct marketing across all

brands and intensify the marketing support behind our e-commerce channel.

In our emerging brands (PBteen, West Elm and Williams-Sonoma Home), we expect to add 14 new retail stores

and plan to continue to focus on building brand awareness and enhancing customer access to the brands. In

PBteen, we will continue to expand our core merchandising categories, increase catalog circulation and expand

our on-line marketing initiatives. We will also be investing in a number of marketing programs to continue to

grow our teen affinity database. In West Elm, we will continue to broaden the appeal of the brand by expanding

the merchandise assortment, including new classifications previously offered in Hold Everything, and further

softening the fabric and finishing choices. We also plan to increase catalog and page circulation, expand our

on-line marketing initiatives, open ten new retail stores, ranging from 15,000 to 25,000 square feet, and continue

to expand our retail-only assortment to support the increased square footage. In Williams-Sonoma Home, in

addition to increasing both catalog and page circulation, we are planning to launch a Williams-Sonoma Home

e-commerce website in the third quarter of fiscal 2006. We also plan to expand both our retail and

direct-to-customer assortments in addition to opening four new retail stores, ranging from 13,000 to 16,000

square feet. Operationally, in this brand, our focus will be on product development, sourcing, and supply chain

customization, in response to the operational challenges we experienced in our distribution network that resulted

in higher than expected returns, replacements, and damages in fiscal 2005.

To increase our pre-tax operating margin, we plan to improve the supply chain cost structure in the areas of

customer returns, replacements, and damages, transportation costs in the furniture delivery network, and

backroom and offsite storage management in our retail stores. We also plan to leverage our general overhead

expenses as we continue our efforts to reduce our fixed and variable cost structure.

Operationally, our key initiatives for fiscal 2006 include: implementing operational disciplines throughout the

supply chain to reduce returns, replacements and damages; testing an extension to our daily store replenishment

program in high-density urban locations whereby both customer delivery and store replenishment operations can

be efficiently combined; improving our furniture sourcing and inventory management disciplines; and

21

Form 10-K