Pottery Barn 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

Fiscal 2005 Financial Results

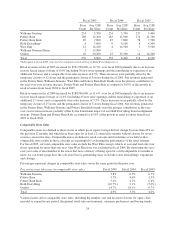

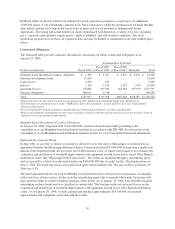

In fiscal 2005, our net revenues increased 12.8% to $3,538,947,000 from $3,136,931,000 in fiscal 2004,

primarily driven by increases in the Pottery Barn, Pottery Barn Kids, Williams-Sonoma, and West Elm concepts.

In fiscal 2005, our diluted earnings per share increased by 13.1% to $1.81 from $1.60 in fiscal 2004, including a

$13,500,000 (pre-tax), or $0.07 per diluted share, Hold Everything charge discussed below.

In our retail channel, net revenues increased 12.3% during fiscal 2005 versus fiscal 2004. This increase was

primarily driven by a year-over-year increase in retail leased square footage of 8.6%, including 18 net new stores,

and a comparable store sales increase of 4.9%. Net revenues generated in the Pottery Barn, Williams-Sonoma,

West Elm and Pottery Barn Kids brands were the primary contributors to this year-over-year net revenues

increase.

In our direct-to-customer channel, net revenues increased 13.6% during fiscal 2005 versus fiscal 2004. This year-

over-year increase was primarily driven by net revenues generated in the Pottery Barn, Pottery Barn Kids, West

Elm and Williams-Sonoma brands due to increased catalog and page circulation and continued strength in our

Internet business. Internet revenues increased 36.5% during fiscal 2005 versus fiscal 2004, primarily resulting

from our expanded efforts associated with our electronic direct marketing initiatives and strategic e-commerce

partnerships, and the incremental net revenues generated by the late 2004 launch of our Hold Everything

e-commerce website. All of our brands in the direct-to-customer channel delivered positive growth during the

fiscal year with the exception of the Hold Everything brand.

In our core brands, net revenues increased 10.9% in fiscal 2005, primarily driven by low double-digit and

low-teen net revenue increases in the Pottery Barn and Pottery Barn Kids brands, respectively, and a high single-

digit net revenue increase in the Williams-Sonoma brand.

In our emerging brands, including Hold Everything, PBteen, West Elm and Williams-Sonoma Home, net

revenues increased 35.6%, primarily driven by the strong performance of the West Elm and Williams-Sonoma

Home brands. In West Elm, the strong growth in e-commerce from the re-launch of the brand’s website to

enhance the customer’s on-line experience and the opening of eight new stores across the country (at an average

size of 17,000 square feet) drove these results. In addition, we continued to broaden the brand’s appeal by

expanding its product assortment, softening the color palate, and presenting the merchandise in a lifestyle setting

in all three channels. In Williams-Sonoma Home, the increased catalog circulation and the opening of three new

prototype stores in September and October (including an 18,000 square foot flagship store in Los Angeles) drove

these results. In addition, throughout the year, we saw a positive consumer response to our expanded

merchandise assortment, with particular strength in furniture and bedding.

In January 2006, we decided to transition the merchandising strategies of our Hold Everything brand into our

other existing brands by the end of fiscal 2006. In connection with this transition, we incurred a pre-tax charge of

approximately $13,500,000, or $0.07 per diluted share, in the fourth quarter of fiscal 2005. These costs primarily

included the initial asset impairment and lease termination costs associated with the shutdown of the Hold

Everything retail stores, the asset impairment of the e-commerce website, and the write-down of impaired

merchandise inventories. Of this pre-tax charge, approximately $4,500,000 is included in cost of goods sold and

approximately $9,000,000 is included in selling, general, and administrative expenses. We expect to incur an

additional after-tax charge of $0.03 per diluted share in the first half of fiscal 2006.

Fiscal 2005 Operational Results

Operationally, in fiscal 2005, we continued to reduce customer shipping costs, driven by the ongoing refining of

our furniture delivery network; we continued to reduce employee benefit costs as a percentage of net revenues,

driven by cost containment strategies in fringe benefits and proactive workers’ compensation initiatives; and we

continued to reduce corporate overhead expenses as a percentage of net revenues, due to strong expense

management initiatives.

20