Pottery Barn 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

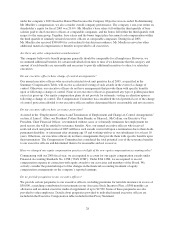

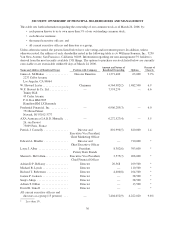

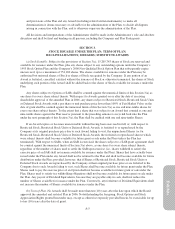

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information regarding securities authorized for issuance under our equity

compensation plans as of January 29, 2006:

Plan category

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights

(a)

Weighted average

exercise price of

outstanding

options, warrants

and rights

(b)

Number of securities

remaining available for future

issuance under equity

compensation plans (excluding

securities reflected in

column (a))

(c)

Equity compensation plans approved by

security holders(1) ................. 10,098,037 $20.93 2,016,661

Equity compensation plans not approved

by security holders(2) .............. 1,051,872 20.86 408,197

Total .............................. 11,149,909 20.93 2,424,858

(1) This reflects our 1993 Stock Option Plan and 2001 Long-Term Incentive Plan and includes grants of

840,000 restricted stock units pursuant to the 2001 Long-Term Incentive Plan in fiscal 2005.

(2) This reflects our 2000 Nonqualified Stock Option Plan.

2000 Nonqualified Stock Option Plan

In July 2000, our Compensation Committee approved the 2000 Nonqualified Stock Option Plan, or the 2000

Plan. The 2000 Plan provides for the grant of nonqualified stock options to employees who are not officers or

members of our Board, and persons who have accepted employment and actually become employees within 120

days of such acceptance. The plan administrator determines when options granted under the 2000 Plan may be

exercised, except that no options may be exercised less than six months after grant, except in the case of the

death or disability of the optionee. Options granted under the 2000 Plan have an exercise price equal to 100% of

the fair market value of the shares underlying the option on the date of grant. The 2000 Plan permits options to be

exercised with cash, check, certain other shares of our common stock, consideration received by us under

“cashless exercise” programs or, if permitted by the plan administrator, promissory notes. In the event that we

dissolve, liquidate, reorganize, merge or consolidate with one or more corporations as a result of which we are

not the surviving corporation, or we sell substantially all of our assets or more than 80% of our then-outstanding

stock, the 2000 Plan provides that the plan administrator will provide for one or more of the following: (i) each

outstanding option will fully vest and become exercisable; (ii) the successor will assume or substitute for the

options; (iii) the 2000 Plan will continue; or (iv) each outstanding option will be exchanged for a payment in cash

or shares equal to the excess of the fair market value of our common stock over the exercise price. There are

3,000,000 shares of common stock reserved under the 2000 Plan, and 407,447 shares remain available for future

issuance. However, as noted in Proposal 2, upon shareholder approval of the amended and restated 2001 Long-

Term Incentive Plan, no future awards will be granted from the 2000 Nonqualified Stock Option Plan.

SHAREHOLDER PROPOSALS

How can shareholders submit a proposal for inclusion in our Proxy Statement for the 2007 Annual

Meeting?

To be included in our Proxy Statement for the 2007 Annual Meeting, shareholder proposals must comply with

the requirements of Rule 14a-8 under the Securities Exchange Act of 1934 and be received by our Secretary at

our principal executive offices no later than December 15, 2006.

How can shareholders submit proposals to be raised at the 2007 Annual Meeting that will not be included

in our Proxy Statement for the 2007 Annual Meeting?

To be raised at the 2007 Annual Meeting, shareholder proposals must comply with our Restated Bylaws. Under

our Restated Bylaws, a shareholder must give advance notice to our Secretary of any business, including

38