Pfizer 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

94

2015 Financial Report

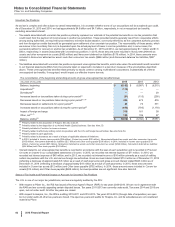

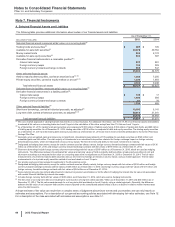

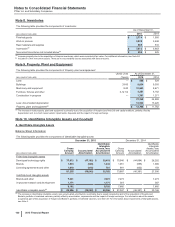

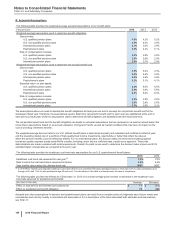

Note 7. Financial Instruments

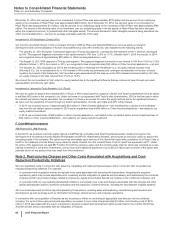

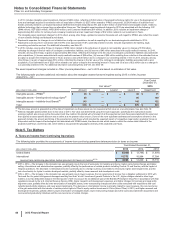

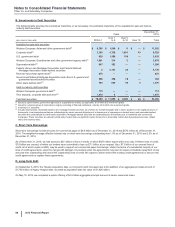

A. Selected Financial Assets and Liabilities

The following table provides additional information about certain of our financial assets and liabilities:

As of December 31,

(MILLIONS OF DOLLARS) 2015 2014

Selected financial assets measured at fair value on a recurring basis(a)

Trading funds and securities(b) $287 $105

Available-for-sale debt securities(c) 32,078 39,762

Money market funds 934 2,174

Available-for-sale equity securities(c) 603 397

Derivative financial instruments in a receivable position(d):

Interest rate swaps 837 801

Foreign currency swaps 135 593

Foreign currency forward-exchange contracts 559 547

35,433 44,379

Other selected financial assets

Held-to-maturity debt securities, carried at amortized cost(c), (e) 1,388 7,255

Private equity securities, carried at equity-method or at cost(e), (f) 1,336 1,993

2,724 9,248

Total selected financial assets $ 38,157 $ 53,627

Selected financial liabilities measured at fair value on a recurring basis(a)

Derivative financial instruments in a liability position(g):

Interest rate swaps $ 139 $17

Foreign currency swaps 1,489 594

Foreign currency forward-exchange contracts 81 78

1,709 689

Other selected financial liabilities(h)

Short-term borrowings, carried at historical proceeds, as adjusted(e) 10,160 5,141

Long-term debt, carried at historical proceeds, as adjusted(i), (j) 28,818 31,541

38,978 36,682

Total selected financial liabilities $ 40,687 $ 37,371

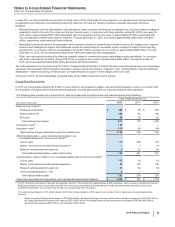

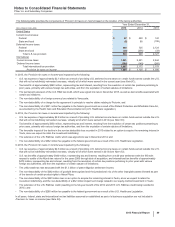

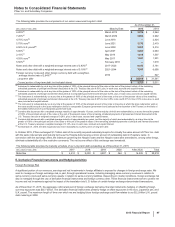

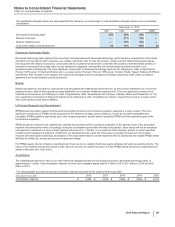

(a) We use a market approach in valuing financial instruments on a recurring basis. For additional information, see Note 1E. All of our financial assets and liabilities

measured at fair value on a recurring basis use Level 2 inputs in the calculation of fair value, except less than 1% that use Level 1 inputs.

(b) As of December 31, 2015, trading funds and securities are composed of $100 million of trading equity funds, $102 million of trading debt funds, and $85 million

of trading equity securities. As of December 31, 2014, trading securities of $105 million is composed of debt and equity securities. The trading equity securities

as of December 31, 2015 and the trading debt and equity securities as of December 31, 2014 are held in trust for benefits attributable to the former Pharmacia

Savings Plus Plan.

(c) Generally, gross unrealized gains and losses are not significant. Unrealized losses related to 2015 available-for-sale debt securities are $593 million and

unrealized gains are $44 million. The vast majority of investments in an unrealized loss position relate to the foreign exchange impact on foreign currency

denominated securities, which are hedged with cross-currency swaps. We have the intent and ability to hold such investments to maturity.

(d) Designated as hedging instruments, except for certain contracts used as offsets; namely, foreign currency forward-exchange contracts with fair values of $136

million as of December 31, 2015; and foreign currency forward-exchange contracts with fair values of $159 million as of December 31, 2014.

(e) Short-term borrowings include foreign currency short-term borrowings with fair values of $547 million as of December 31, 2015, which are used as hedging

instruments. The differences between the estimated fair values and carrying values of held-to-maturity debt securities, private equity securities at cost and

short-term borrowings not measured at fair value on a recurring basis were not significant as of December 31, 2015 or December 31, 2014. The fair value

measurements of our held-to-maturity debt securities and our short-term borrowings are based on Level 2 inputs, using a market approach. The fair value

measurements of our private equity securities carried at cost are based on Level 3 inputs.

(f) Our private equity securities represent investments in the life sciences sector.

(g) Designated as hedging instruments, except for certain contracts used as offsets; namely, foreign currency swaps with fair values of $234 million and foreign

currency forward-exchange contracts with fair values of $59 million as of December 31, 2015; and foreign currency swaps with fair values of $121 million and

foreign currency forward-exchange contracts with fair values of $54 million as of December 31, 2014.

(h) Some carrying amounts may include adjustments for discount or premium amortization or for the effect of hedging the interest rate fair value risk associated

with certain financial liabilities by interest rate swaps.

(i) Includes foreign currency debt with fair values of $560 million as of December 31, 2014, which are used as hedging instruments.

(j) The fair value of our long-term debt (not including the current portion of long-term debt) was $32.7 billion as of December 31, 2015 and $36.6 billion as of

December 31, 2014. The fair value measurements for our long-term debt are based on Level 2 inputs, using a market approach. Generally, the difference

between the fair value of our long-term debt and the amount reported on the consolidated balance sheet is due to a decline in relative market interest rates

since the debt issuance.

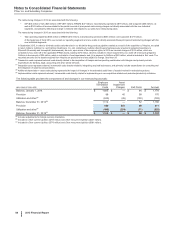

A single estimate of fair value can result from a complex series of judgments about future events and uncertainties and can rely heavily on

estimates and assumptions. For a description of our general accounting policies associated with developing fair value estimates, see Note 1E.

For a description of the risks associated with estimates and assumptions, see Note 1C.